Claims Adjuster I Salary in the United States

Claims Adjuster I Salary

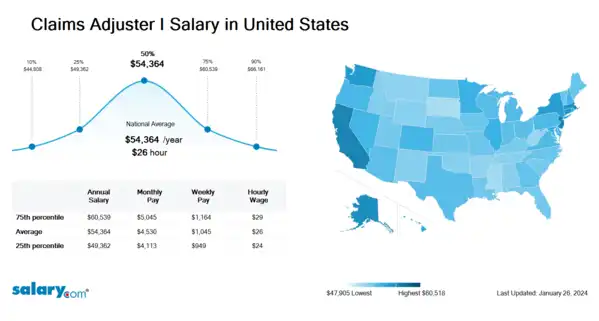

How much does a Claims Adjuster I make in the United States? The average Claims Adjuster I salary in the United States is $54,636 as of March 26, 2024, but the range typically falls between $49,603 and $60,839. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Claims Adjuster I Salary | $45,020 | US | March 26, 2024 |

| 25th Percentile Claims Adjuster I Salary | $49,603 | US | March 26, 2024 |

| 50th Percentile Claims Adjuster I Salary | $54,636 | US | March 26, 2024 |

| 75th Percentile Claims Adjuster I Salary | $60,839 | US | March 26, 2024 |

| 90th Percentile Claims Adjuster I Salary | $66,486 | US | March 26, 2024 |

CorVel Healthcare Corporation - Cincinnati, OH

PURIS Corporation, LLC - Columbus, OH

Vehicle Service Contract Adjuster I (On-Site Position)

AUTOMOBILE PROTECTION CORPORATION - Westerville, OH

VSC Adjuster (On-Site Position)

AUTOMOBILE PROTECTION CORPORATION - Westerville, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Claims Adjuster I need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Subrogation: Subrogation is the assumption by a third party of another party's legal right to collect a debt or damages. It is a legal doctrine whereby one person is entitled to enforce the subsisting or revived rights of another for one's own benefit.

Background Check: A background check or background investigation is a review of a potential employee's criminal, commercial and financial records. The goal of background checks is to ensure the safety and security of the employees in the organisation

Job Description for Claims Adjuster I

Claims Adjuster I denies, settles, or authorizes payments to routine property/casualty claims based on coverage, appraisal, and verifiable damage. Corresponds with policyholders, claimants, witnesses, attorneys, etc. to gather important information to support contested insurance claims. Being a Claims Adjuster I makes recommendations for settlement of routine property/casualty claims based on coverage, appraisal, and verifiable damage. Prepares reports of investigation findings. Additionally, Claims Adjuster I may conduct field evaluations to inspect and document damage or loss. Typically requires an associate degree. Typically reports to a supervisor or manager. The Claims Adjuster I works on projects/matters of limited complexity in a support role. Work is closely managed. To be a Claims Adjuster I typically requires 0-2 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Claims Adjuster I.

Search Job Openings

Salary.com job board provides millions of Claims Adjuster I information for you to search for. Click on search button below to see Claims Adjuster I job openings or enter a new job title here.

Career Path for Claims Adjuster I

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Claims Adjuster I, the upper level is Claims Adjuster II and then progresses to Claims Adjuster III.

What does a Claims Adjuster I do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Claims Adjuster I Pay Difference by Location

Claims Adjuster I salary varies from city to city. Compared with national average salary of Claims Adjuster I, the highest Claims Adjuster I salary is in San Francisco, CA, where the Claims Adjuster I salary is 25.0% above. The lowest Claims Adjuster I salary is in Miami, FL, where the Claims Adjuster I salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Claims Adjuster I

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Claims Adjuster II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Claims Adjuster III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Claims Clerk I | Experience 0 - 1 | EducationHigh School | Salary Compared to This Job |

| Job Title Claims Examiner I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Claims Examiner II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

Level of Education for Claims Adjuster I

Jobs with different levels of education may pay very differently. Check the Claims Adjuster I salary of your education level.

- Claims Adjuster I Salaries with a High School Diploma or Technical Certificate

- Claims Adjuster I Salaries with an Associate's Degree

- Claims Adjuster I Salaries with a Bachelor's Degree

- Claims Adjuster I Salaries with a Master's Degree or MBA

- Claims Adjuster I Salaries with a JD, MD, PhD or Equivalent

Claims Adjuster I Salary by Global Country

Claims Adjuster I salary varies from country to country. There are several factors that mainly impact the Claims Adjuster I salary, including cost of living, economic conditions, market rates and legal differences. Click below to Claims Adjuster I salary of the other country.

Claims Adjuster I Salary by State

Geographic variations impact Claims Adjuster I salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Accounting Jobs by Salary Level

Browse Related Job Categories With Claims Adjuster I

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Claims Adjuster I salary varies from category to category. Click below to see Claims Adjuster I salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Claims Adjuster I, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Claims Adjuster I: Insurance Claims Management Software, Customer Support, Calculate Payments/Premiums, Claim Reviews ...More

Recently searched related titles: Automotive Claims Adjuster

Recently searched companies with related titles : General Electric Damage Adjuster Trainee, AAA Insurance Company Claims Adjuster

Recently searched related titles: Auto Claim Representative, Casualty Claims Representative, Independent Adjuster

Jobs with a similar salary range to Claims Adjuster I : Claims Adjuster Trainee, Field Auto Adjuster, Liability Claims Representative, Property Field Claim Adjuster, Complex Claims Adjuster, Claims Adjuster Auto

Salary estimation for Claims Adjuster I at companies like : Northeast Region, Marshall County Emergency, Sterling Astrip Drugs

Jobs with a similar salary range to Claims Adjuster I : Public Adjuster, Music Curator, Insurance Claim Adjuster