Credit Analyst I Salary in Wisconsin

Credit Analyst I Salary in Wisconsin

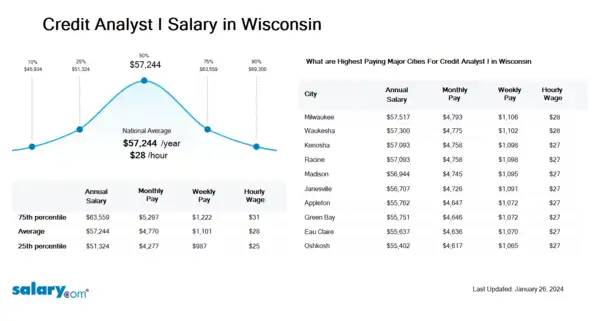

How much does a Credit Analyst I make in Wisconsin? The average Credit Analyst I salary in Wisconsin is $57,745 as of March 26, 2024, but the range typically falls between $51,774 and $64,114. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Credit Analyst I Salary | $46,338 | WI | March 26, 2024 |

| 25th Percentile Credit Analyst I Salary | $51,774 | WI | March 26, 2024 |

| 50th Percentile Credit Analyst I Salary | $57,745 | WI | March 26, 2024 |

| 75th Percentile Credit Analyst I Salary | $64,114 | WI | March 26, 2024 |

| 90th Percentile Credit Analyst I Salary | $69,912 | WI | March 26, 2024 |

DLS Engineering - 96853, HI

Financial Systems Analyst or Senior (depending on experience)

Ent Credit Union - Colorado Springs, CO

Member Service Representative I

WHITEFISH CREDIT UNION ASSOCIATION - Kalispell, MT

Novel Capital - Kansas City, KS

- View Average Salary for United States

-

Select State

-

Select City in WI

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Wisconsin

What skills does a Credit Analyst I need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Analysis: Analysis is the process of considering something carefully or using statistical methods in order to understand it or explain it.

Credit Risk: Credit risk is the possibility of loss due to a borrower's defaulting on a loan or not meeting contractual obligations.

Transportation: Refers to the mode of travel used to get from home to work most frequently. The transportation are bus, train, aeroplane, ship, car, etc while the mode of transportation refers to road, air, sea/ocean, etc.

Job Description for Credit Analyst I

Credit Analyst I analyzes the creditworthiness of prospective and current customers. Examines credit history using credit agency tools and evaluates potential risks. Being a Credit Analyst I makes recommendations on credit extensions within established guidelines. May make recommendations regarding bad debt or write-offs. Additionally, Credit Analyst I typically requires a bachelor's degree. Typically reports to a supervisor or manager. The Credit Analyst I works on projects/matters of limited complexity in a support role. Work is closely managed. To be a Credit Analyst I typically requires 0-2 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Credit Analyst I.

Search Job Openings

Salary.com job board provides millions of Credit Analyst I information for you to search for. Click on search button below to see Credit Analyst I job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Credit Analyst I

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Abbotsford, WI | Avg. Salary $54,530 | Date Updated March 26, 2024 |

| Location Abrams, WI | Avg. Salary $55,582 | Date Updated March 26, 2024 |

| Location Adams, WI | Avg. Salary $57,102 | Date Updated March 26, 2024 |

| Location Adell, WI | Avg. Salary $57,628 | Date Updated March 26, 2024 |

| Location Afton, WI | Avg. Salary $56,926 | Date Updated March 26, 2024 |

| Location Albany, WI | Avg. Salary $56,926 | Date Updated March 26, 2024 |

| Location Algoma, WI | Avg. Salary $55,290 | Date Updated March 26, 2024 |

| Location Allenton, WI | Avg. Salary $57,628 | Date Updated March 26, 2024 |

| Location Alma, WI | Avg. Salary $58,037 | Date Updated March 26, 2024 |

| Location Alma Center, WI | Avg. Salary $54,530 | Date Updated March 26, 2024 |

Career Path for Credit Analyst I

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Credit Analyst I, the upper level is Credit Analyst II and then progresses to Credit Analysis Manager.

What does a Credit Analyst I do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Wisconsin

Similar Jobs to Credit Analyst I

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Commercial Credit Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Analyst III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

Level of Education for Credit Analyst I

Jobs with different levels of education may pay very differently. Check the Credit Analyst I salary of your education level.

Credit Analyst I Salary by Global Country

Credit Analyst I salary varies from country to country. There are several factors that mainly impact the Credit Analyst I salary, including cost of living, economic conditions, market rates and legal differences. Click below to Credit Analyst I salary of the other country.

View Salary Data for All Nearby Cities

Iowa

Illinois

Minnesota

Most Popular Cities for Credit Analyst I Job

Browse All Accounting Jobs by Salary Level

Browse Related Job Categories With Credit Analyst I

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Credit Analyst I salary varies from category to category. Click below to see Credit Analyst I salary in different categories.

About Wisconsin Wisconsin is bordered by the Montreal River; Lake Superior and Michigan to the north; by Lake Michigan to the east; by Illinois to the south; and by I....More

Skills associated with Credit Analyst I: Credit and Collections Software, Risk Analysis, Financial Analysis Software

Jobs with a similar salary range to Credit Analyst I : Business Credit Analyst, Corporate Credit Analyst, Credit Rating Analyst, Coordinator - Credit, Associate Analyst, Credit

Salary estimation for Credit Analyst I at companies like : North Bay Country Dance Society, Burlington Probation and Parole Departme Jan, Power Technologies LLC

Jobs with a similar salary range to Credit Analyst I : Rotational Program, Genomic Technologist