Mortgage Credit Analyst Salary in Wisconsin

Mortgage Credit Analyst Salary in Wisconsin

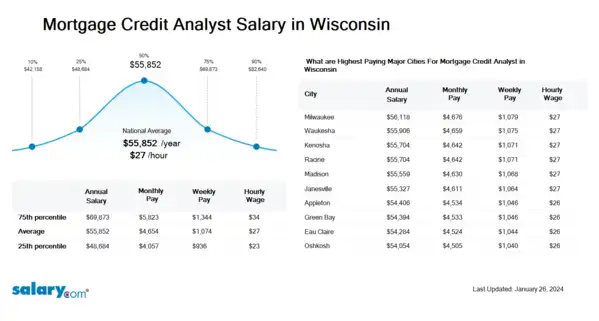

How much does a Mortgage Credit Analyst make in Wisconsin? The average Mortgage Credit Analyst salary in Wisconsin is $56,305 as of March 26, 2024, but the range typically falls between $49,081 and $70,439. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Mortgage Credit Analyst Salary | $42,503 | WI | March 26, 2024 |

| 25th Percentile Mortgage Credit Analyst Salary | $49,081 | WI | March 26, 2024 |

| 50th Percentile Mortgage Credit Analyst Salary | $56,305 | WI | March 26, 2024 |

| 75th Percentile Mortgage Credit Analyst Salary | $70,439 | WI | March 26, 2024 |

| 90th Percentile Mortgage Credit Analyst Salary | $83,308 | WI | March 26, 2024 |

North Star Austin - Austin, TX

Golden Empire Mortgage Inc - Bakersfield, CA

Mortgage Solutions Financial - Colorado Springs, CO

Primary Residential Mortgage - Fort Collins, CO

- View Average Salary for United States

-

Select State

-

Select City in WI

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Wisconsin

What skills does a Mortgage Credit Analyst need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Analysis: Analysis is the process of considering something carefully or using statistical methods in order to understand it or explain it.

Microsoft Office: Microsoft Office is a suite of desktop productivity applications that is designed by Microsoft for business use. You can create documents containing text and images, work with data in spreadsheets and databases, create presentations and posters.

Loan Review: Loan review is a process routinely used by banks to assess the current value of loan portfolios. Provisioning is a technique to translate loan review results into the balance sheet.

Job Description for Mortgage Credit Analyst

Mortgage Credit Analyst assesses the risk and creditworthiness of loan applicants and recommends loan approval, terms, or application denial. Gathers necessary credit, income, and tax information to conduct financial assessments. Being a Mortgage Credit Analyst reviews and verifies property appraisals, collateral value, and key indicators such as debt-to-income and loan-to-value ratios. Prepares a detailed credit analysis and summary using underwriting guidelines, risk assessment frameworks, and following applicable regulatory compliance. Additionally, Mortgage Credit Analyst may require a bachelor's degree. Typically reports to a manager. The Mortgage Credit Analyst work is closely managed. Works on projects/matters of limited complexity in a support role. To be a Mortgage Credit Analyst typically requires 0-2 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Mortgage Credit Analyst.

Search Job Openings

Salary.com job board provides millions of Mortgage Credit Analyst information for you to search for. Click on search button below to see Mortgage Credit Analyst job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Mortgage Credit Analyst

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Abbotsford, WI | Avg. Salary $53,170 | Date Updated March 26, 2024 |

| Location Abrams, WI | Avg. Salary $54,196 | Date Updated March 26, 2024 |

| Location Adams, WI | Avg. Salary $55,678 | Date Updated March 26, 2024 |

| Location Adell, WI | Avg. Salary $56,191 | Date Updated March 26, 2024 |

| Location Afton, WI | Avg. Salary $55,507 | Date Updated March 26, 2024 |

| Location Albany, WI | Avg. Salary $55,507 | Date Updated March 26, 2024 |

| Location Algoma, WI | Avg. Salary $53,911 | Date Updated March 26, 2024 |

| Location Allenton, WI | Avg. Salary $56,191 | Date Updated March 26, 2024 |

| Location Alma, WI | Avg. Salary $56,590 | Date Updated March 26, 2024 |

| Location Alma Center, WI | Avg. Salary $53,170 | Date Updated March 26, 2024 |

Career Path for Mortgage Credit Analyst

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Mortgage Credit Analyst, the upper level is Mortgage Underwriter II and then progresses to Mortgage Underwriter IV.

What does a Mortgage Credit Analyst do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Wisconsin

Similar Jobs to Mortgage Credit Analyst

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Credit Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Analyst III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

Level of Education for Mortgage Credit Analyst

Jobs with different levels of education may pay very differently. Check the Mortgage Credit Analyst salary of your education level.

- Mortgage Credit Analyst Salaries with a High School Diploma or Technical Certificate

- Mortgage Credit Analyst Salaries with an Associate's Degree

- Mortgage Credit Analyst Salaries with a Bachelor's Degree

- Mortgage Credit Analyst Salaries with a Master's Degree or MBA

- Mortgage Credit Analyst Salaries with a JD, MD, PhD or Equivalent

View Salary Data for All Nearby Cities

Iowa

Illinois

Minnesota

Most Popular Cities for Mortgage Credit Analyst Job

- Jacksonville, FL Mortgage Credit Analyst

- Chicago, IL Mortgage Credit Analyst

- Boston, MA Mortgage Credit Analyst

- San Antonio, TX Mortgage Credit Analyst

- San Diego, CA Mortgage Credit Analyst

- Austin, TX Mortgage Credit Analyst

- Dallas, TX Mortgage Credit Analyst

- Washington, DC Mortgage Credit Analyst

- Cleveland, OH Mortgage Credit Analyst

- Charlotte, NC Mortgage Credit Analyst

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Mortgage Credit Analyst

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Mortgage Credit Analyst salary varies from category to category. Click below to see Mortgage Credit Analyst salary in different categories.

About Wisconsin Wisconsin is bordered by the Montreal River; Lake Superior and Michigan to the north; by Lake Michigan to the east; by Illinois to the south; and by I....More

Skills associated with Mortgage Credit Analyst: Loan Review, Loan Underwriting, Mortgage Loans, Regulatory Compliance ...More

Recently searched related titles: Game Writer

Jobs with a similar salary range to Mortgage Credit Analyst : Loan Specialist, Commercial Loan Analyst, Mortgage Analyst

Salary estimation for Mortgage Credit Analyst at companies like : Smokin Js B-B-Q, Cosmetology College, Cole MT Fort Worth TX LLC

Jobs with a similar salary range to Mortgage Credit Analyst : Growth Executive, Nuclear Mechanic