Trader (Retail Municipal Bonds) Salary in the United States

Trader (Retail Municipal Bonds) Salary

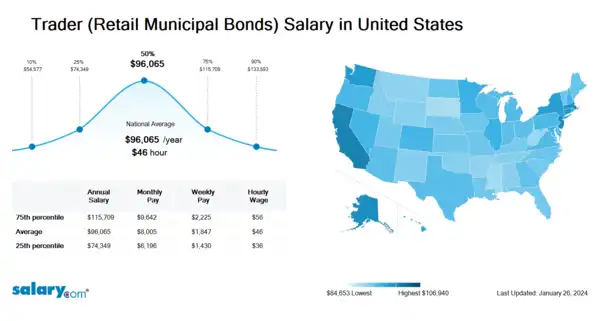

How much does a Trader (Retail Municipal Bonds) make in the United States? The average Trader (Retail Municipal Bonds) salary in the United States is $96,788 as of March 26, 2024, but the range typically falls between $74,906 and $116,517. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Trader (Retail Municipal Bonds) Salary | $54,984 | US | March 26, 2024 |

| 25th Percentile Trader (Retail Municipal Bonds) Salary | $74,906 | US | March 26, 2024 |

| 50th Percentile Trader (Retail Municipal Bonds) Salary | $96,788 | US | March 26, 2024 |

| 75th Percentile Trader (Retail Municipal Bonds) Salary | $116,517 | US | March 26, 2024 |

| 90th Percentile Trader (Retail Municipal Bonds) Salary | $134,479 | US | March 26, 2024 |

Meeder Investment Management - Dublin, OH

Avery Dennison - Painesville, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Trader (Retail Municipal Bonds) need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Analysis: Analysis is the process of considering something carefully or using statistical methods in order to understand it or explain it.

Pricing: Pricing is a process of fixing the value that a manufacturer will receive in the exchange of services and goods.

Investment Management: Investment management (or financial management) is the professional asset management of various securities (shares, bonds and other securities) and other assets (e.g., real estate) in order to meet specified investment goals for the benefit of the investors. Investors may be institutions (insurance companies, pension funds, corporations, charities, educational establishments etc.) or private investors (both directly via investment contracts and more commonly via collective investment schemes e.g. mutual funds or exchange-traded funds). The term 'asset management' is often used to refer to the investment management of investment funds, while the more generic term 'fund management' may refer to all forms of institutional investment as well as investment management for private investors. Investment managers who specialize in advisory or discretionary management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management often within the context of "private banking".

Job Description for Trader (Retail Municipal Bonds)

Trader (Retail Municipal Bonds) is responsible for the timely buying and selling of retail municipal bonds. Executes orders and reviews documentation to ensure accuracy, proper record keeping, and compliance to regulations. Being a Trader (Retail Municipal Bonds) evaluates market volatility and ensures clients receive the best rate available. Establishes connections with other dealers to ensure inventory of bonds is maximized. Additionally, Trader (Retail Municipal Bonds) requires a bachelor's degree. Typically reports to a manager. May require state licensure. The Trader (Retail Municipal Bonds) contributes to moderately complex aspects of a project. Work is generally independent and collaborative in nature. To be a Trader (Retail Municipal Bonds) typically requires 4 to 7 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Trader (Retail Municipal Bonds).

Search Job Openings

Salary.com job board provides millions of Trader (Retail Municipal Bonds) information for you to search for. Click on search button below to see Trader (Retail Municipal Bonds) job openings or enter a new job title here.

What does a Trader (Retail Municipal Bonds) do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Trader (Retail Municipal Bonds) Pay Difference by Location

Trader (Retail Municipal Bonds) salary varies from city to city. Compared with national average salary of Trader (Retail Municipal Bonds), the highest Trader (Retail Municipal Bonds) salary is in San Francisco, CA, where the Trader (Retail Municipal Bonds) salary is 25.0% above. The lowest Trader (Retail Municipal Bonds) salary is in Miami, FL, where the Trader (Retail Municipal Bonds) salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Trader (Retail Municipal Bonds)

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Retail Loss Prevention Representative II | Experience 1 - 3 | EducationHigh School | Salary Compared to This Job |

| Job Title Retail Store Customer Service Representative | Experience 0 - 1 | EducationHigh School | Salary Compared to This Job |

| Job Title Retail Store Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Retail Store Shift Supervisor | Experience 2 + | EducationHigh School | Salary Compared to This Job |

| Job Title Retail Third Keyholder | Experience 3 - 5 | EducationHigh School | Salary Compared to This Job |

Level of Education for Trader (Retail Municipal Bonds)

Jobs with different levels of education may pay very differently. Check the Trader (Retail Municipal Bonds) salary of your education level.

Trader (Retail Municipal Bonds) Salary by State

Geographic variations impact Trader (Retail Municipal Bonds) salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Financial Services Jobs by Salary Level

Browse Related Job Categories With Trader (Retail Municipal Bonds)

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Trader (Retail Municipal Bonds) salary varies from category to category. Click below to see Trader (Retail Municipal Bonds) salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Trader (Retail Municipal Bonds), base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Trader (Retail Municipal Bonds): Securities Laws and Regulations, Brokerage Trading Software, Trading, Order Processing ...More

Salary estimation for Trader (Retail Municipal Bonds) at companies like : Veneer Company LP, Fresno 220 Holdings VI LLC, US Export Enforcement