How much does a Tax Specialist make in Birmingham, UK? The average Tax Specialist salary in Birmingham, UK is £30,204 as of March 03, 2021, but the range typically falls between £24,003 and £37,257. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more global market data that allows you to price your jobs around the world and compare job salaries across countries and cities on real-time compensation data, Salary.com helps you to determine your exact pay target.

-

Choose Global Country

-

-

View Average Salary for the United Kingdom

-

Choose Similar Job

-

Pick Related Category

-

Find More Jobs in the United Kingdom

What does a Tax Specialist do?

Be the first to add Tax Specialist responsibilities.

Not the job you're looking for? Search more salaries here:

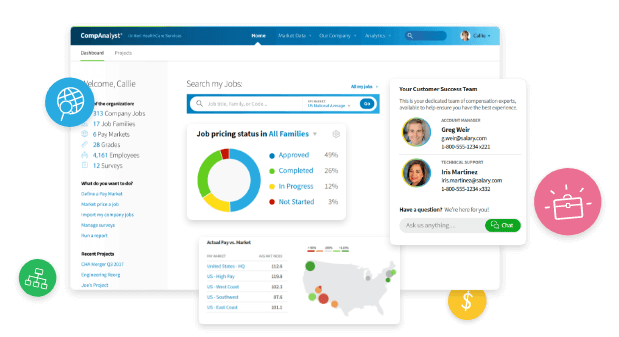

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Birmingham, United Kingdom

About Birmingham, United Kingdom

Birmingham is located in the centre of the West Midlands region of England on the Birmingham Plateau – an area of relatively high ground, ranging between 500 and 1,000 feet (150 and 300 metres) above sea level and crossed by Britain's main north–south watershed between the basins of the Rivers Severn and Trent. To the south west of the city lie the Lickey Hills, Clent Hills and Walton Hill, which reach 1,033 feet (315 m) and have extensive views over the city. Birmingham is drained only by minor rivers and brooks, primarily the River Tame and its tributaries the Cole and the Rea.

The City of ...

Source: Wikipedia (as of 03/30/2021). Read more from Wikipedia

Tax Specialist Pay Difference by Cities

Tax Specialist Pay Difference by Cities

| City, Country | Compared to national average |

|---|---|

| City, Country London, UK |

Compared to national average

|

| City, Country Manchester, UK |

Compared to national average

|

| City, Country Liverpool, UK |

Compared to national average

|

| City, Country Leicester, UK |

Compared to national average

|

| City, Country Birmingham, UK |

Compared to national average

|

| City, Country Brighton and Hove, UK |

Compared to national average

|

Employees with Tax Specialist in their job title in London, UK earn an average of 6.9% more than the national average. The lower salaries can be found in Leicester, UK (6.2% less), Liverpool, UK (5.5% less), Birmingham, UK (5.2% less), Manchester, UK (5.2% less).

Similar Jobs to Tax Specialist in Birmingham, UK

Loading results...

| Job Title | Location | Salary Range in GBP |

|---|---|---|

| Job Title Tax Accountant | Location Birmingham, UK |

|

| Job Title Tax Accountant - Project Lead Specialist | Location Birmingham, UK |

|

| Job Title Tax Accountant IV | Location Birmingham, UK |

|

| Job Title Tax Associate | Location Birmingham, UK |

|

| Job Title Tax Consultant | Location Birmingham, UK |

|

Understand the base salary paid range for a Tax Specialist in Birmingham, UK

Understand the base salary paid range for a Tax Specialist in Birmingham, UK

Average Base Salary

Core compensation

24003

37257

The chart shows the base salary for Tax Specialist in Birmingham ranges from £24,003 to £37,257 with the average base salary of £30,204. The basic salary is the employee minimum income you can expect to earn in exchange for your time or services. This is the amount earned before adding benefits, bonuses, or compensation. The base salary of the Tax Specialist may get paid difference by industry, location, and factors.

Tax Specialist Frequently Asked Questions

Tax Specialist Frequently Asked Questions

Can I expect to receive a higher salary for the position of Tax Specialist in London than for the same job in Leicester in the United Kingdom?

On average, a Tax Specialist, working in London, United Kingdom, would generally get a higher salary than those working in the city of Leicester. The larger cities in the UK typically provide numerous opportunities for Tax Specialist Jobs. Since Birmingham, United Kingdom is an attractive place to work for many professions, Tax Specialist Jobs could be competitive. Candidates need to consider personal preferences when deciding on a work location and weigh all factors including employment viability, cost of living, workforce competition, and quality of life in a particular location.

March 03, 2021

salary.com

)

What is the salary range for a Tax Specialist in Birmingham, United Kingdom? What is the average hourly rate?

The average salary for a Tax Specialist in Birmingham, United Kingdom is £30,204 per year. The salary range for a Tax Specialist is between £24,003 and £37,257. While we are seeing hourly wages as high as £18 and as low as £12, the majority of Tax Specialists are currently paid an average of £15 in Birmingham, United Kingdom. The average salary pay range for a Tax Specialist can vary depending on specific skills, level of skill, location, education, and years of experience. The company size, industry, and location, and numbers of available job candidates may also affect salary offers. Salaries for a Tax Specialist in Birmingham, United Kingdom can differ based on any or all of these varying factors.

March 03, 2021

salary.com

)

Besides the base pay, what other benefits might be negotiable when considering a Tax Specialist job? What common items are generally included in a total compensation package?

A total compensation package consists of base pay or salary and all other types of pay and benefits that a Tax Specialist working in Birmingham, United Kingdom will receive in exchange for their job. Some common items included in the total compensation of a Tax Specialist working in the Birmingham, United Kingdom are bonuses, medical/dental/vision benefits coverage, paid leaves, life insurance, and pension plan company match. Some companies in the Birmingham, United Kingdom might also offer long-term incentives such as stock options or stock grants for Tax Specialists. Other popular benefits are gym memberships, free parking, monthly car expenses, free food, and company discounts. Evaluate all offered benefits to determine if they are of value to you. Consider items that you value and see if you can negotiate favorable terms for them. For example, request an extra week of vacation, reimbursement for training, flexible work hours, or subsidized parking. These perks have a value that should be included when you evaluate the entire compensation package offered to you.

March 03, 2021

salary.com

)

Last Update: March 03, 2021