Investment Portfolio Manager Salary in Texas

Investment Portfolio Manager Salary in Texas

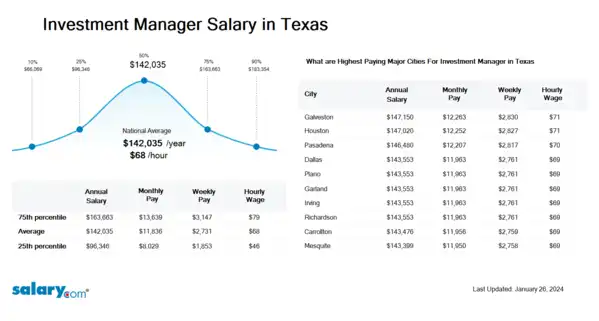

How much does an Investment Portfolio Manager make in Texas? The average Investment Portfolio Manager salary in Texas is $133,311 as of April 24, 2024, but the range typically falls between $98,073 and $173,405. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Investment Portfolio Manager Salary | $67,254 | TX | April 24, 2024 |

| 25th Percentile Investment Portfolio Manager Salary | $98,073 | TX | April 24, 2024 |

| 50th Percentile Investment Portfolio Manager Salary | $133,311 | TX | April 24, 2024 |

| 75th Percentile Investment Portfolio Manager Salary | $173,405 | TX | April 24, 2024 |

| 90th Percentile Investment Portfolio Manager Salary | $209,909 | TX | April 24, 2024 |

- View Average Salary for United States

-

Select State

-

Select City in TX

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Texas

What skills does an Investment Portfolio Manager need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Due Diligence: Due diligence is the investigation or exercise of care that a reasonable business or person is expected to take before entering into an agreement or contract with another party, or an act with a certain standard of care. It can be a legal obligation, but the term will more commonly apply to voluntary investigations. A common example of due diligence in various industries is the process through which a potential acquirer evaluates a target company or its assets for an acquisition. The theory behind due diligence holds that performing this type of investigation contributes significantly to informed decision making by enhancing the amount and quality of information available to decision makers and by ensuring that this information is systematically used to deliberate in a reflexive manner on the decision at hand and all its costs, benefits, and risks.

Investment Management: Investment management (or financial management) is the professional asset management of various securities (shares, bonds and other securities) and other assets (e.g., real estate) in order to meet specified investment goals for the benefit of the investors. Investors may be institutions (insurance companies, pension funds, corporations, charities, educational establishments etc.) or private investors (both directly via investment contracts and more commonly via collective investment schemes e.g. mutual funds or exchange-traded funds). The term 'asset management' is often used to refer to the investment management of investment funds, while the more generic term 'fund management' may refer to all forms of institutional investment as well as investment management for private investors. Investment managers who specialize in advisory or discretionary management on behalf of (normally wealthy) private investors may often refer to their services as money management or portfolio management often within the context of "private banking".

Job Description for Investment Portfolio Manager

Investment Portfolio Manager manages the securities, assets, and investment portfolios of a bank. Establishes investment policies to ensure financial activities are compliant with regulatory standards and requirements. Being an Investment Portfolio Manager monitors and tracks financial markets, investment trends, and regulatory developments to implement successful investment strategies and recommends changes to manage risk and increase returns. Oversees and routinely assesses portfolio allocation to evaluate performance and alignment with investment objectives, strategies, and risk tolerance levels. Additionally, Investment Portfolio Manager requires a bachelor's degree. Typically reports to a director. The Investment Portfolio Manager manages subordinate staff in the day-to-day performance of their jobs. True first level manager. Ensures that project/department milestones/goals are met and adhering to approved budgets. Has full authority for personnel actions. To be an Investment Portfolio Manager typically requires 5 years experience in the related area as an individual contributor. 1-3 years supervisory experience may be required. Extensive knowledge of the function and department processes. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Investment Portfolio Manager.

Search Job Openings

Salary.com job board provides millions of Investment Portfolio Manager information for you to search for. Click on search button below to see Investment Portfolio Manager job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Investment Portfolio Manager

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Abbott, TX | Avg. Salary $120,920 | Date Updated April 24, 2024 |

| Location Abernathy, TX | Avg. Salary $121,056 | Date Updated April 24, 2024 |

| Location Abilene, TX | Avg. Salary $121,737 | Date Updated April 24, 2024 |

| Location Ace, TX | Avg. Salary $130,315 | Date Updated April 24, 2024 |

| Location Ackerly, TX | Avg. Salary $120,511 | Date Updated April 24, 2024 |

| Location Addison, TX | Avg. Salary $134,400 | Date Updated April 24, 2024 |

| Location Adkins, TX | Avg. Salary $128,409 | Date Updated April 24, 2024 |

| Location Adrian, TX | Avg. Salary $122,690 | Date Updated April 24, 2024 |

| Location Afton, TX | Avg. Salary $120,511 | Date Updated April 24, 2024 |

| Location Agua Dulce, TX | Avg. Salary $126,775 | Date Updated April 24, 2024 |

What does an Investment Portfolio Manager do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Texas

Similar Jobs to Investment Portfolio Manager

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Investment Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Investment Analyst III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Investment Analyst IV | Experience 7 + | EducationBachelors | Salary Compared to This Job |

| Job Title Investment Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Investment Senior Manager | Experience | EducationBachelors | Salary Compared to This Job |

Level of Education for Investment Portfolio Manager

Jobs with different levels of education may pay very differently. Check the Investment Portfolio Manager salary of your education level.

- Investment Portfolio Manager Salaries with No Diploma

- Investment Portfolio Manager Salaries with a High School Diploma or Technical Certificate

- Investment Portfolio Manager Salaries with an Associate's Degree

- Investment Portfolio Manager Salaries with a Bachelor's Degree

- Investment Portfolio Manager Salaries with a Master's Degree or MBA

- Investment Portfolio Manager Salaries with a JD, MD, PhD or Equivalent

Investment Portfolio Manager Salary by Global Country

Investment Portfolio Manager salary varies from country to country. There are several factors that mainly impact the Investment Portfolio Manager salary, including cost of living, economic conditions, market rates and legal differences. Click below to Investment Portfolio Manager salary of the other country.

View Salary Data for All Nearby Cities

Louisiana

New Mexico

Oklahoma

Most Popular Cities for Investment Portfolio Manager Job

- Houston, TX Investment Portfolio Manager

- Philadelphia, PA Investment Portfolio Manager

- Los Angeles, CA Investment Portfolio Manager

- San Diego, CA Investment Portfolio Manager

- San Antonio, TX Investment Portfolio Manager

- New York, NY Investment Portfolio Manager

- Dallas, TX Investment Portfolio Manager

- Phoenix, AZ Investment Portfolio Manager

- San Jose, CA Investment Portfolio Manager

- Chicago, IL Investment Portfolio Manager

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Investment Portfolio Manager

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Investment Portfolio Manager salary varies from category to category. Click below to see Investment Portfolio Manager salary in different categories.

About Texas Texas (/ˈtɛksəs/, locally /ˈtɛksɪz/; Spanish: Texas or Tejas Spanish pronunciation: [ˈtexas] (listen)) is the second largest state in the United State....More

Skills associated with Investment Portfolio Manager: Investment Analysis, Risk Analysis, Financial Analysis Software, Trend Analysis ...More

Recently searched related titles: Technology Evangelist, Director Of Quality And Regulatory Affairs, Investment Risk Manager

Jobs with a similar salary range to Investment Portfolio Manager : IT Portfolio Manager, Analyst, Portfolio Management, Investment Accountant Manager

Salary estimation for Investment Portfolio Manager at companies like : Fannin 44 LLC, Menendez Financial Group LLC, ROST BROTHERS INTERNATIONAL Inc