Consumer Loan Collection Manager Salary in South Dakota

Consumer Loan Collection Manager Salary in South Dakota

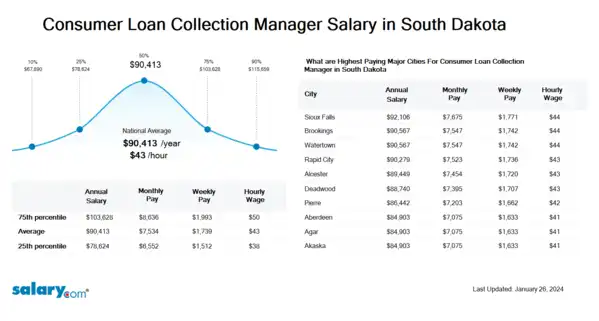

How much does a Consumer Loan Collection Manager make in South Dakota? The average Consumer Loan Collection Manager salary in South Dakota is $92,685 as of March 26, 2024, but the range typically falls between $80,599 and $106,231. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Consumer Loan Collection Manager Salary | $69,595 | SD | March 26, 2024 |

| 25th Percentile Consumer Loan Collection Manager Salary | $80,599 | SD | March 26, 2024 |

| 50th Percentile Consumer Loan Collection Manager Salary | $92,685 | SD | March 26, 2024 |

| 75th Percentile Consumer Loan Collection Manager Salary | $106,231 | SD | March 26, 2024 |

| 90th Percentile Consumer Loan Collection Manager Salary | $118,565 | SD | March 26, 2024 |

Foothill Federal Credit Union - Arcadia, CA

Loan Specialist (Bilingual Dallas/Fort Worth)

UMortgage - Fort Worth, TX

Lending Contact Center Loan Officer II

Premier America Credit Union - Los Angeles, CA

Royal Business Bank - Los Angeles, CA

- View Average Salary for United States

-

Select State

-

Select City in SD

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in South Dakota

What skills does a Consumer Loan Collection Manager need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Futures: Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price.

Loss Mitigation: Loss mitigation is used to describe a third party helping a homeowner, a division within a bank that mitigates the loss of the bank, or a firm that handles the process of negotiation between a homeowner and the homeowner's lender. Loss mitigation works to negotiate mortgage terms for the homeowner that will prevent foreclosure. These new terms are typically obtained through loan modification, short sale negotiation, short refinance negotiation, deed in lieu of foreclosure, cash-for-keys negotiation, a partial claim loan, repayment plan, forbearance, or other loan work-out. All of the options serve the same purpose, to stabilize the risk of loss the lender (investor) is in danger of realizing../

Job Description for Consumer Loan Collection Manager

Consumer Loan Collection Manager manages a group of collection supervisors and develops collection strategies to minimize collection portfolio loss. Responsible for initial and ongoing training of all subordinate personnel. Being a Consumer Loan Collection Manager requires a bachelor's degree. Typically reports to a top management. The Consumer Loan Collection Manager typically manages through subordinate managers and professionals in larger groups of moderate complexity. Provides input to strategic decisions that affect the functional area of responsibility. May give input into developing the budget. To be a Consumer Loan Collection Manager typically requires 3+ years of managerial experience. Capable of resolving escalated issues arising from operations and requiring coordination with other departments. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Consumer Loan Collection Manager.

Search Job Openings

Salary.com job board provides millions of Consumer Loan Collection Manager information for you to search for. Click on search button below to see Consumer Loan Collection Manager job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Consumer Loan Collection Manager

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Deadwood, SD | Avg. Salary $90,210 | Date Updated March 26, 2024 |

| Location Pierre, SD | Avg. Salary $86,808 | Date Updated March 26, 2024 |

| Location Watertown, SD | Avg. Salary $92,066 | Date Updated March 26, 2024 |

| Location Aberdeen, SD | Avg. Salary $85,262 | Date Updated March 26, 2024 |

| Location Agar, SD | Avg. Salary $85,262 | Date Updated March 26, 2024 |

| Location Akaska, SD | Avg. Salary $85,262 | Date Updated March 26, 2024 |

| Location Alcester, SD | Avg. Salary $91,448 | Date Updated March 26, 2024 |

| Location Alexandria, SD | Avg. Salary $92,066 | Date Updated March 26, 2024 |

| Location Allen, SD | Avg. Salary $90,210 | Date Updated March 26, 2024 |

| Location Alpena, SD | Avg. Salary $88,664 | Date Updated March 26, 2024 |

What does a Consumer Loan Collection Manager do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About South Dakota

Similar Jobs to Consumer Loan Collection Manager

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Consumer Loan Collection Supervisor I | Experience 3 + | EducationBachelors | Salary Compared to This Job |

| Job Title Consumer Loan Collection Supervisor II | Experience 3 - 5 | EducationBachelors | Salary Compared to This Job |

| Job Title Consumer Loan Collection/Recovery Manager | Experience | EducationBachelors | Salary Compared to This Job |

| Job Title Consumer Loan Collection/Recovery Rep. I | Experience 0 - 1 | EducationHigh School | Salary Compared to This Job |

| Job Title Consumer Loan Collection/Recovery Rep. II | Experience 1 - 3 | EducationHigh School | Salary Compared to This Job |

Level of Education for Consumer Loan Collection Manager

Jobs with different levels of education may pay very differently. Check the Consumer Loan Collection Manager salary of your education level.

View Salary Data for All Nearby Cities

Most Popular Cities for Consumer Loan Collection Manager Job

- Baltimore, MD Consumer Loan Collection Manager

- Virginia Beach, VA Consumer Loan Collection Manager

- San Diego, CA Consumer Loan Collection Manager

- New York, NY Consumer Loan Collection Manager

- Las Vegas, NV Consumer Loan Collection Manager

- Cincinnati, OH Consumer Loan Collection Manager

- Washington, DC Consumer Loan Collection Manager

- Tampa, FL Consumer Loan Collection Manager

- Dayton, OH Consumer Loan Collection Manager

- Chicago, IL Consumer Loan Collection Manager

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Consumer Loan Collection Manager

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Consumer Loan Collection Manager salary varies from category to category. Click below to see Consumer Loan Collection Manager salary in different categories.

About South Dakota South Dakota (/- dəˈkoʊtə/ (listen)) is a U.S. state in the Midwestern region of the United States. It is named after the Lakota and Dakota Sioux Nati....More

Skills associated with Consumer Loan Collection Manager: Banking Software, Staff Training, Credit and Collections Software, Loan Collections

Salary estimation for Consumer Loan Collection Manager at companies like : Haddonfield Police Departments, Gerry Imber, MD, Solar Panel Companies