Insurance Claim Service Representative III Salary in Connecticut

Insurance Claim Service Representative III Salary in Connecticut

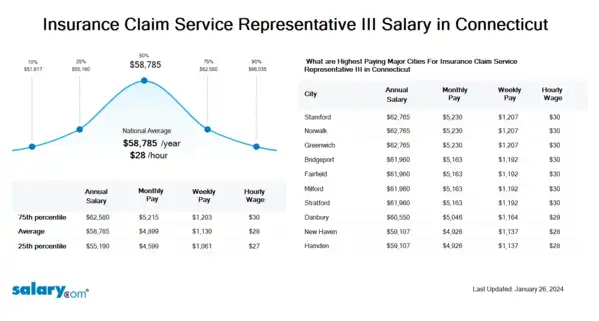

How much does an Insurance Claim Service Representative III make in Connecticut? The average Insurance Claim Service Representative III salary in Connecticut is $59,088 as of May 28, 2024, but the range typically falls between $55,475 and $62,910. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Insurance Claim Service Representative III Salary | $52,185 | CT | May 28, 2024 |

| 25th Percentile Insurance Claim Service Representative III Salary | $55,475 | CT | May 28, 2024 |

| 50th Percentile Insurance Claim Service Representative III Salary | $59,088 | CT | May 28, 2024 |

| 75th Percentile Insurance Claim Service Representative III Salary | $62,910 | CT | May 28, 2024 |

| 90th Percentile Insurance Claim Service Representative III Salary | $66,390 | CT | May 28, 2024 |

- View Average Salary for United States

-

Select State

-

Select City in CT

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Connecticut

What skills does an Insurance Claim Service Representative III need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Underwriting: Underwriting services are provided by some large financial institutions, such as banks, or insurance or investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issue of securities in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. The name derives from the Lloyd's of London insurance market. Financial bankers, who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose.

Product Knowledge: Product knowledge is the ability to communicate information and answer questions about a product or service. It is considered an important knowledge area for any role that puts you in front of customers, investors or the media.

What Should I Pay?

Job Description for Insurance Claim Service Representative III

Insurance Claim Service Representative III processes, adjusts, and closes claims of moderate complexity in a contact center setting. Prepares initial claim reports, records statements from involved parties, and maintains First Notice of Loss (FNOL) information. Being an Insurance Claim Service Representative III negotiates settlements within approved limits. Does not handle claims requiring outside field adjustment and refers complex claims to designated experts. Additionally, Insurance Claim Service Representative III may handle claims for bodily injury and third-party loss. Requires a high school diploma or equivalent. Typically reports to a supervisor or manager. The Insurance Claim Service Representative III works independently within established procedures associated with the specific job function. Has gained proficiency in multiple competencies relevant to the job. To be an Insurance Claim Service Representative III typically requires 3-5 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Insurance Claim Service Representative III.

Search Job Openings

Salary.com job board provides millions of Insurance Claim Service Representative III information for you to search for. Click on search button below to see Insurance Claim Service Representative III job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Insurance Claim Service Representative III

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location New London, CT | Avg. Salary $58,648 | Date Updated May 28, 2024 |

| Location Norwich, CT | Avg. Salary $58,758 | Date Updated May 28, 2024 |

| Location West Haven, CT | Avg. Salary $59,363 | Date Updated May 28, 2024 |

| Location Abington, CT | Avg. Salary $58,098 | Date Updated May 28, 2024 |

| Location Amston, CT | Avg. Salary $58,813 | Date Updated May 28, 2024 |

| Location Andover, CT | Avg. Salary $59,033 | Date Updated May 28, 2024 |

| Location Ansonia, CT | Avg. Salary $59,363 | Date Updated May 28, 2024 |

| Location Ashford, CT | Avg. Salary $58,098 | Date Updated May 28, 2024 |

| Location Avon, CT | Avg. Salary $59,143 | Date Updated May 28, 2024 |

| Location Ballouville, CT | Avg. Salary $58,043 | Date Updated May 28, 2024 |

Career Path for Insurance Claim Service Representative III

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Insurance Claim Service Representative III, the upper level is Insurance Claim Service Team Supervisor and then progresses to Insurance Claim Service Manager I.

What does an Insurance Claim Service Representative III do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Connecticut

Similar Jobs to Insurance Claim Service Representative III

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Claims Examiner III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Customer Service Representative III | Experience 3 - 5 | EducationHigh School | Salary Compared to This Job |

| Job Title Insurance Claim Service Manager I | Experience 3 - 5 | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Claim Service Manager II | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Claim Service Representative I | Experience 0 - 1 | EducationHigh School | Salary Compared to This Job |

Level of Education for Insurance Claim Service Representative III

Jobs with different levels of education may pay very differently. Check the Insurance Claim Service Representative III salary of your education level.

- Insurance Claim Service Representative III Salaries with No Diploma

- Insurance Claim Service Representative III Salaries with a High School Diploma or Technical Certificate

- Insurance Claim Service Representative III Salaries with an Associate's Degree

- Insurance Claim Service Representative III Salaries with a Bachelor's Degree

- Insurance Claim Service Representative III Salaries with a Master's Degree or MBA

- Insurance Claim Service Representative III Salaries with a JD, MD, PhD or Equivalent

View Salary Data for All Nearby Cities

Massachusetts

New York

Rhode Island

Most Popular Cities for Insurance Claim Service Representative III Job

- Houston, TX Insurance Claim Service Representative III

- Philadelphia, PA Insurance Claim Service Representative III

- Los Angeles, CA Insurance Claim Service Representative III

- San Diego, CA Insurance Claim Service Representative III

- San Antonio, TX Insurance Claim Service Representative III

- New York, NY Insurance Claim Service Representative III

- Dallas, TX Insurance Claim Service Representative III

- Phoenix, AZ Insurance Claim Service Representative III

- San Jose, CA Insurance Claim Service Representative III

- Chicago, IL Insurance Claim Service Representative III

Browse All Insurance Jobs by Salary Level

Browse Related Job Categories With Insurance Claim Service Representative III

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Insurance Claim Service Representative III salary varies from category to category. Click below to see Insurance Claim Service Representative III salary in different categories.

About Connecticut Connecticut is bordered on the south by Long Island Sound, on the west by New York, on the north by Massachusetts, and on the east by Rhode Island. Th....More

Skills associated with Insurance Claim Service Representative III: Claim Investigation, Loss/Damage Claims, Insurance Claims Management Software, Insurance Products Servicing ...More

Recently searched related titles: Conference Room Coordinator, Unmanned Aircraft Systems Operator, Aircraft Engine Technician

Jobs with a similar salary range to Insurance Claim Service Representative III : Life Insurance Specialist, OMS

Salary estimation for Insurance Claim Service Representative III at companies like : South Campus Gallery, Volvo Trucks Customer Center, Branson School District

Jobs with a similar salary range to Insurance Claim Service Representative III : Ghostwriter, Aircraft Deicer, Aircraft Washer