Mortgage Underwriting Manager Salary in the United States

Mortgage Underwriting Manager Salary

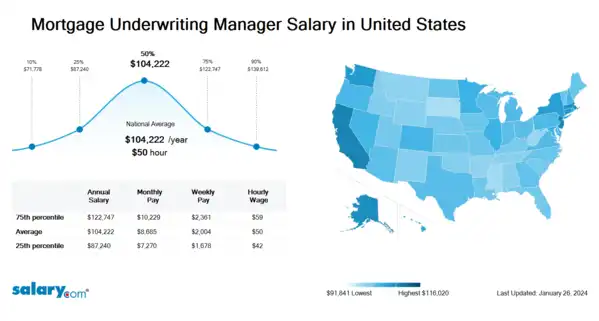

How much does a Mortgage Underwriting Manager make in the United States? The average Mortgage Underwriting Manager salary in the United States is $105,377 as of June 27, 2024, but the range typically falls between $88,199 and $124,107. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Mortgage Underwriting Manager Salary | $72,559 | US | June 27, 2024 |

| 25th Percentile Mortgage Underwriting Manager Salary | $88,199 | US | June 27, 2024 |

| 50th Percentile Mortgage Underwriting Manager Salary | $105,377 | US | June 27, 2024 |

| 75th Percentile Mortgage Underwriting Manager Salary | $124,107 | US | June 27, 2024 |

| 90th Percentile Mortgage Underwriting Manager Salary | $141,160 | US | June 27, 2024 |

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Mortgage Underwriting Manager need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Leadership: Knowledge of and ability to employ effective strategies that motivate and guide other members within our business to achieve optimum results.

Mortgage Banking: Mortgage banking generally involves loan originations as well as purchases and sales of loans through the secondary mortgage market. A bank engaged in mortgage banking may retain or sell loans it originates or purchases from affiliates, brokers, or correspondents.

Microsoft Office: Microsoft Office is a suite of desktop productivity applications that is designed by Microsoft for business use. You can create documents containing text and images, work with data in spreadsheets and databases, create presentations and posters.

What Should I Pay?

Job Description for Mortgage Underwriting Manager

Mortgage Underwriting Manager provides quality mortgage loans to customers. Reviews and develops all aspects of mortgage loan guidelines to ensure compliance with federal and state regulations. Being a Mortgage Underwriting Manager monitors processes and systems of mortgage loans and promotes the new line of businesses. Requires a bachelor's degree. Additionally, Mortgage Underwriting Manager typically reports to a head of a unit/department. The Mortgage Underwriting Manager manages subordinate staff in the day-to-day performance of their jobs. True first level manager. Ensures that project/department milestones/goals are met and adhering to approved budgets. Has full authority for personnel actions. Extensive knowledge of department processes. To be a Mortgage Underwriting Manager typically requires 5 years experience in the related area as an individual contributor. 1 to 3 years supervisory experience may be required. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Mortgage Underwriting Manager.

Search Job Openings

Salary.com job board provides millions of Mortgage Underwriting Manager information for you to search for. Click on search button below to see Mortgage Underwriting Manager job openings or enter a new job title here.

What does a Mortgage Underwriting Manager do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Mortgage Underwriting Manager Pay Difference by Location

Mortgage Underwriting Manager salary varies from city to city. Compared with national average salary of Mortgage Underwriting Manager, the highest Mortgage Underwriting Manager salary is in San Francisco, CA, where the Mortgage Underwriting Manager salary is 25.0% above. The lowest Mortgage Underwriting Manager salary is in Miami, FL, where the Mortgage Underwriting Manager salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Mortgage Underwriting Manager

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Life Underwriting Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Operations Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Underwriter I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Underwriter II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Underwriter III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

Level of Education for Mortgage Underwriting Manager

Jobs with different levels of education may pay very differently. Check the Mortgage Underwriting Manager salary of your education level.

Mortgage Underwriting Manager Salary by State

Geographic variations impact Mortgage Underwriting Manager salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Mortgage Underwriting Manager

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Mortgage Underwriting Manager salary varies from category to category. Click below to see Mortgage Underwriting Manager salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Mortgage Underwriting Manager, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Mortgage Underwriting Manager: Real Estate Appraisal Report, Mortgage Loans, Lending Regulatory Compliance, Underwriting & Rating Software

Jobs with a similar salary range to Mortgage Underwriting Manager : Commercial Credit Manager, Mortgage Manager, Mortgage Underwriter Team Lead

Salary estimation for Mortgage Underwriting Manager at companies like : Kelvin Medical Hospital, TEDxUniversityofPittsburgh xts h, First National Bank & Trust of Ardmore