Risk Analyst III Salary in Wisconsin

Risk Analyst III Salary in Wisconsin

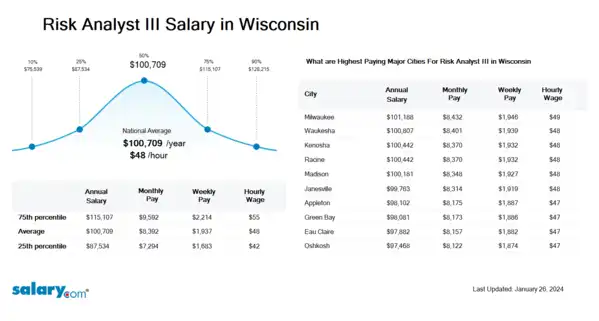

How much does a Risk Analyst III make in Wisconsin? The average Risk Analyst III salary in Wisconsin is $101,880 as of April 24, 2024, but the range typically falls between $88,555 and $116,444. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Risk Analyst III Salary | $76,422 | WI | April 24, 2024 |

| 25th Percentile Risk Analyst III Salary | $88,555 | WI | April 24, 2024 |

| 50th Percentile Risk Analyst III Salary | $101,880 | WI | April 24, 2024 |

| 75th Percentile Risk Analyst III Salary | $116,444 | WI | April 24, 2024 |

| 90th Percentile Risk Analyst III Salary | $129,703 | WI | April 24, 2024 |

- View Average Salary for United States

-

Select State

-

Select City in WI

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Wisconsin

What skills does a Risk Analyst III need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Risk Management: Risk management is the identification, evaluation, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities. Risks can come from various sources including uncertainty in financial markets, threats from project failures (at any phase in design, development, production, or sustainment life-cycles), legal liabilities, credit risk, accidents, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root-cause. There are two types of events i.e. negative events can be classified as risks while positive events are classified as opportunities. Several risk management standards have been developed including the Project Management Institute, the National Institute of Standards and Technology, actuarial societies, and ISO standards. Methods, definitions and goals vary widely according to whether the risk management method is in the context of project management, security, engineering, industrial processes, financial portfolios, actuarial assessments, or public health and safety.

Trading: Trading is the act or process of buying, selling, or exchanging commodities, at either wholesale or retail, within a country or between countries.

SQL: Structured Query Language) is a domain-specific language used in programming and designed for managing data held in a relational database management system (RDBMS), or for stream processing in a relational data stream management system (RDSMS).

Job Description for Risk Analyst III

Risk Analyst III evaluates the vulnerability of an organization's assets to determine the potential risk factors. Performs statistical analysis to quantify risk and forecast probable outcomes. Being a Risk Analyst III prepares reports and presents findings to assist management with decision-making while offering solutions to minimize or eliminate risks. Monitors internal and external risk factors including economic, market, and regulatory risks to continuously maintain maximum protection of an organization's assets. Additionally, Risk Analyst III supports managers in risk management or risk model construction. Requires a bachelor's degree. Typically reports to a supervisor. The Risk Analyst III work is generally independent and collaborative in nature. Contributes to moderately complex aspects of a project. To be a Risk Analyst III typically requires 4-7 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Risk Analyst III.

Search Job Openings

Salary.com job board provides millions of Risk Analyst III information for you to search for. Click on search button below to see Risk Analyst III job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Risk Analyst III

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Abbotsford, WI | Avg. Salary $96,209 | Date Updated April 24, 2024 |

| Location Abrams, WI | Avg. Salary $98,065 | Date Updated April 24, 2024 |

| Location Adams, WI | Avg. Salary $100,746 | Date Updated April 24, 2024 |

| Location Adell, WI | Avg. Salary $101,674 | Date Updated April 24, 2024 |

| Location Afton, WI | Avg. Salary $100,437 | Date Updated April 24, 2024 |

| Location Albany, WI | Avg. Salary $100,437 | Date Updated April 24, 2024 |

| Location Algoma, WI | Avg. Salary $97,549 | Date Updated April 24, 2024 |

| Location Allenton, WI | Avg. Salary $101,674 | Date Updated April 24, 2024 |

| Location Alma, WI | Avg. Salary $102,396 | Date Updated April 24, 2024 |

| Location Alma Center, WI | Avg. Salary $96,209 | Date Updated April 24, 2024 |

Career Path for Risk Analyst III

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Risk Analyst III, the first career path typically progresses to E-commerce Risk Director.

The second career path typically starts with an Insurance Risk Analyst IV position, and then progresses to Insurance Risk Analyst V.

The third career path typically starts with a Risk Analyst IV position, and then progresses to Risk Analyst V.

Additionally, the fourth career path typically progresses to Workers' Compensation Claims Manager.

What does a Risk Analyst III do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Wisconsin

Similar Jobs to Risk Analyst III

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Information Security Analyst III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Risk Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Risk Analyst II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Risk Analyst III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Insurance Risk Analyst IV | Experience 7 + | EducationBachelors | Salary Compared to This Job |

Level of Education for Risk Analyst III

Jobs with different levels of education may pay very differently. Check the Risk Analyst III salary of your education level.

Risk Analyst III Salary by Global Country

Risk Analyst III salary varies from country to country. There are several factors that mainly impact the Risk Analyst III salary, including cost of living, economic conditions, market rates and legal differences. Click below to Risk Analyst III salary of the other country.

View Salary Data for All Nearby Cities

Iowa

Illinois

Minnesota

Most Popular Cities for Risk Analyst III Job

- Houston, TX Risk Analyst III

- Los Angeles, CA Risk Analyst III

- San Francisco, CA Risk Analyst III

- Boston, MA Risk Analyst III

- San Diego, CA Risk Analyst III

- New York, NY Risk Analyst III

- Minneapolis, MN Risk Analyst III

- San Jose, CA Risk Analyst III

- Washington, DC Risk Analyst III

- Chicago, IL Risk Analyst III

Browse All Financial Services Jobs by Salary Level

Browse Related Job Categories With Risk Analyst III

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Risk Analyst III salary varies from category to category. Click below to see Risk Analyst III salary in different categories.

About Wisconsin Wisconsin is bordered by the Montreal River; Lake Superior and Michigan to the north; by Lake Michigan to the east; by Illinois to the south; and by I....More

Skills associated with Risk Analyst III: Loss Prevention, Risk Assessment, Statistical Analysis, Operational Risk ...More

Recently searched related titles: Middle Office Analyst

Recently searched related titles: Third Party Risk Analyst, Quantitative Risk Analyst

Jobs with a similar salary range to Risk Analyst III : Foreign Affairs Officer, Risk Control Consultant, SAS Consultant, Enterprise Risk Officer

Salary estimation for Risk Analyst III at companies like : FCB Retail Store, Minneapolis Public School District, Oright America Inc

Jobs with a similar salary range to Risk Analyst III : Risk Adjustment Analyst, Risk Adjustment Coder, Risk Engineer