Compliance Investigator Salary in the United States

Compliance Investigator Salary

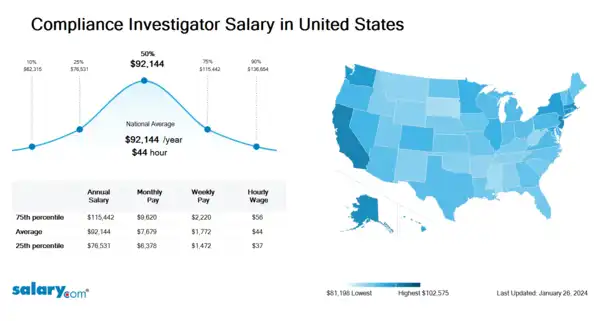

How much does a Compliance Investigator make in the United States? The average Compliance Investigator salary in the United States is $92,506 as of March 26, 2024, but the range typically falls between $76,826 and $115,888. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Compliance Investigator Salary | $62,551 | US | March 26, 2024 |

| 25th Percentile Compliance Investigator Salary | $76,826 | US | March 26, 2024 |

| 50th Percentile Compliance Investigator Salary | $92,506 | US | March 26, 2024 |

| 75th Percentile Compliance Investigator Salary | $115,888 | US | March 26, 2024 |

| 90th Percentile Compliance Investigator Salary | $137,176 | US | March 26, 2024 |

Safety Manager 1099 Short Term

SAVI EHS - Berlin Center, OH

Allied Universal® Compliance and Investigations - Cleveland, OH

Associate Legal Counsel, Compliance

Abercrombie and Fitch Co. - Columbus, OH

Veterans Sourcing Group - Columbus, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Compliance Investigator need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Risk Management: Risk management is the identification, evaluation, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities. Risks can come from various sources including uncertainty in financial markets, threats from project failures (at any phase in design, development, production, or sustainment life-cycles), legal liabilities, credit risk, accidents, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root-cause. There are two types of events i.e. negative events can be classified as risks while positive events are classified as opportunities. Several risk management standards have been developed including the Project Management Institute, the National Institute of Standards and Technology, actuarial societies, and ISO standards. Methods, definitions and goals vary widely according to whether the risk management method is in the context of project management, security, engineering, industrial processes, financial portfolios, actuarial assessments, or public health and safety.

Operational Risk: Operational risk is "the risk of a change in value caused by the fact that actual losses, incurred for inadequate or failed internal processes, people and systems, or from external events (including legal risk), differ from the expected losses". This definition, adopted by the European Solvency II Directive for insurers, is a variation from that adopted in the Basel II regulations for banks. In October 2014, the Basel Committee on Banking Supervision proposed a revision to its operational risk capital framework that sets out a new standardized approach to replace the basic indicator approach and the standardized approach for calculating operational risk capital. It can also include other classes of risks, such as fraud, security, privacy protection, legal risks, physical (e.g. infrastructure shutdown) or environmental risks. The study of operational risk is a broad discipline, close to good management and quality management.

Futures: Futures are derivative financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and set price.

Job Description for Compliance Investigator

Compliance Investigator conducts investigations of alleged violations of the corporation's ethical standards or non-compliance with applicable laws, regulations and corporate policy. Ensures that investigations follow the approved process, are lawfully and objectively conducted, are thorough in gathering all material facts and present an accurate accounting of the issues. Being a Compliance Investigator presents clear, concise, and factual reports that enable fair and relevant decisions to be made. Recommends proactive measures that will reduce the risk of similar future incidents. Additionally, Compliance Investigator typically requires a bachelor's degree. Typically reports to a manager or head of a unit/department. May require a Certified Fraud Examiner (CFE) certification. The Compliance Investigator contributes to moderately complex aspects of a project. Work is generally independent and collaborative in nature. To be a Compliance Investigator typically requires 4 to 7 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Compliance Investigator.

Search Job Openings

Salary.com job board provides millions of Compliance Investigator information for you to search for. Click on search button below to see Compliance Investigator job openings or enter a new job title here.

Career Path for Compliance Investigator

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Compliance Investigator, the first career path typically starts with a Compliance Specialist IV position, and then progresses to Compliance Specialist V.

Additionally, the second career path typically progresses to Compliance Investigation Manager.

What does a Compliance Investigator do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Compliance Investigator Pay Difference by Location

Compliance Investigator salary varies from city to city. Compared with national average salary of Compliance Investigator, the highest Compliance Investigator salary is in San Francisco, CA, where the Compliance Investigator salary is 25.0% above. The lowest Compliance Investigator salary is in Miami, FL, where the Compliance Investigator salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Compliance Investigator

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Compliance Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Compliance Manager, Senior | Experience | EducationBachelors | Salary Compared to This Job |

| Job Title Compliance Specialist I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Compliance Specialist II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Compliance Specialist III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

Level of Education for Compliance Investigator

Jobs with different levels of education may pay very differently. Check the Compliance Investigator salary of your education level.

- Compliance Investigator Salaries with No Diploma

- Compliance Investigator Salaries with a High School Diploma or Technical Certificate

- Compliance Investigator Salaries with an Associate's Degree

- Compliance Investigator Salaries with a Bachelor's Degree

- Compliance Investigator Salaries with a Master's Degree or MBA

- Compliance Investigator Salaries with a JD, MD, PhD or Equivalent

Compliance Investigator Salary by State

Geographic variations impact Compliance Investigator salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Legal Services Jobs by Salary Level

Browse Related Job Categories With Compliance Investigator

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Compliance Investigator salary varies from category to category. Click below to see Compliance Investigator salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Compliance Investigator, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Compliance Investigator: Regulatory Reporting, Ethics Violation Reporting, Compliance Management, Fraud Management ...More

Recently searched related titles: District Attorney Investigator, Legal Investigator, Principal Investigator

Recently searched companies with related titles : Home Depot Inc. Investigator

Recently searched related titles: Internal Investigator, Environmental Compliance Inspector, Equal Opportunity Investigator

Jobs with a similar salary range to Compliance Investigator : Child Protective Investigator, Legal Compliance Officer, Compliance Inspector

Salary estimation for Compliance Investigator at companies like : Dental Loupes www.LoupesDirect.com, Ocean County Department of Health, Verizon Turnkey Services

Jobs with a similar salary range to Compliance Investigator : Complaints Investigator, Anti Money Laundering Investigator, Complaint Investigator