Tax Attorney II Salary in the United States

Tax Attorney II Salary

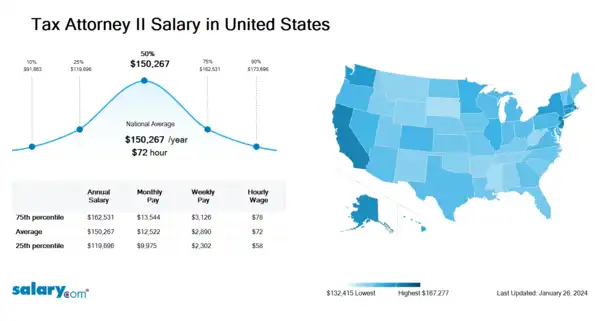

How much does a Tax Attorney II make in the United States? The average Tax Attorney II salary in the United States is $151,662 as of June 27, 2024, but the range typically falls between $120,812 and $164,036. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Tax Attorney II Salary | $92,725 | US | June 27, 2024 |

| 25th Percentile Tax Attorney II Salary | $120,812 | US | June 27, 2024 |

| 50th Percentile Tax Attorney II Salary | $151,662 | US | June 27, 2024 |

| 75th Percentile Tax Attorney II Salary | $164,036 | US | June 27, 2024 |

| 90th Percentile Tax Attorney II Salary | $175,302 | US | June 27, 2024 |

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Tax Attorney II need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Planning: An act or process of making or carrying out plans. Establishment of goals, policies, and procedures for a social or economic unit city planning business planning.

Estate Planning: Estate planning is the process of anticipating and arranging, during a person's life, for the management and disposal of that person's estate during the person's life and at and after death, while minimizing gift, estate, generation skipping transfer, and income tax. Estate planning includes planning for incapacity as well as a process of reducing or eliminating uncertainties over the administration of a probate and maximizing the value of the estate by reducing taxes and other expenses. The ultimate goal of estate planning can be determined by the specific goals of the client, and may be as simple or complex as the client's needs dictate. Guardians are often designated for minor children and beneficiaries in incapacity. The law of estate planning overlaps to some degree with elder law, which additionally includes other provisions such as long-term care.

Blockchain: Blockchain is the grow list of records, called blocks, which are securely linked together using cryptography.

What Should I Pay?

Job Description for Tax Attorney II

Tax Attorney II acts as organization's representation in dealing with local, state, and federal taxing agencies. Responsible for developing tax saving plans and preparing legal documents involving liabilities. Being a Tax Attorney II offers counsel on the impact of tax laws and preparation of tax activities. Requires a Juris Doctor degree from an accredited law school. Additionally, Tax Attorney II requires admittance to a state bar. Typically reports to a manager or head of a unit/department. The Tax Attorney II occasionally directed in several aspects of the work. Gaining exposure to some of the complex tasks within the job function. To be a Tax Attorney II typically requires 2 -4 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Tax Attorney II.

Search Job Openings

Salary.com job board provides millions of Tax Attorney II information for you to search for. Click on search button below to see Tax Attorney II job openings or enter a new job title here.

Career Path for Tax Attorney II

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Tax Attorney II, the upper level is Tax Attorney III and then progresses to Tax Attorney IV.

What does a Tax Attorney II do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Tax Attorney II Pay Difference by Location

Tax Attorney II salary varies from city to city. Compared with national average salary of Tax Attorney II, the highest Tax Attorney II salary is in San Francisco, CA, where the Tax Attorney II salary is 25.0% above. The lowest Tax Attorney II salary is in Miami, FL, where the Tax Attorney II salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Tax Attorney II

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Attorney II | Experience 2 - 4 | EducationJD | Salary Compared to This Job |

| Job Title SVP of Tax | Experience | EducationMasters | Salary Compared to This Job |

| Job Title Tax Accountant II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Tax Attorney I | Experience 0 - 2 | EducationJD | Salary Compared to This Job |

| Job Title Tax Attorney III | Experience 4 - 7 | EducationJD | Salary Compared to This Job |

Level of Education for Tax Attorney II

Jobs with different levels of education may pay very differently. Check the Tax Attorney II salary of your education level.

Tax Attorney II Salary by State

Geographic variations impact Tax Attorney II salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Legal Services Jobs by Salary Level

Browse Related Job Categories With Tax Attorney II

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Tax Attorney II salary varies from category to category. Click below to see Tax Attorney II salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Tax Attorney II, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Tax Attorney II: Litigation Case Management, Legal Case Management Software, Tax Preparation, Document Review ...More

Jobs with a similar salary range to Tax Attorney II : Tax Attorney

Salary estimation for Tax Attorney II at companies like : Smith Medical Holdings Inc, Northern State University Student Center, Skysignal Telecommunications Network Inc

Jobs with a similar salary range to Tax Attorney II : Tax Resolution Specialist, Head Of Innovation