Actuary II Salary in the United States

Actuary II Salary

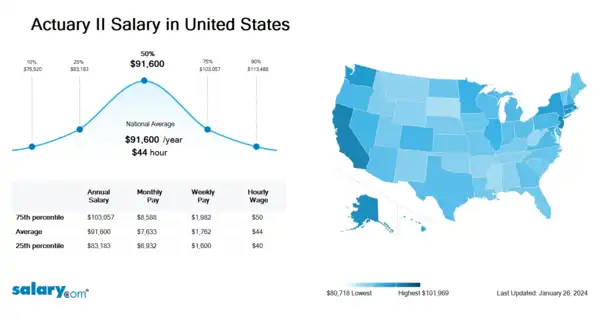

How much does an Actuary II make in the United States? The average Actuary II salary in the United States is $89,777 as of March 26, 2024, but the range typically falls between $81,524 and $99,041. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Actuary II Salary | $74,011 | US | March 26, 2024 |

| 25th Percentile Actuary II Salary | $81,524 | US | March 26, 2024 |

| 50th Percentile Actuary II Salary | $89,777 | US | March 26, 2024 |

| 75th Percentile Actuary II Salary | $99,041 | US | March 26, 2024 |

| 90th Percentile Actuary II Salary | $107,476 | US | March 26, 2024 |

Burtch Works - Cincinnati, OH

Encore Talent Solutions - Cincinnati, OH

Staff Financial Group - Cleveland, OH

Staff Financial Group - Columbus, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does an Actuary II need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Analysis: Analysis is the process of considering something carefully or using statistical methods in order to understand it or explain it.

Health Care: Health care or healthcare is the improvement of health via the prevention, diagnosis, treatment, amelioration, or cure of disease, illness, injury, and other physical and mental impairments in people.

Collective Bargaining: Collective bargaining is a process of negotiation between employers and a group of employees aimed at agreements to regulate working salaries, working conditions, benefits, and other aspects of workers' compensation and rights for workers. The interests of the employees are commonly presented by representatives of a trade union to which the employees belong. The collective agreements reached by these negotiations usually set out wage scales, working hours, training, health and safety, overtime, grievance mechanisms, and rights to participate in workplace or company affairs. The union may negotiate with a single employer (who is typically representing a company's shareholders) or may negotiate with a group of businesses, depending on the country, to reach an industry-wide agreement. A collective agreement functions as a labour contract between an employer and one or more unions. Collective bargaining consists of the process of negotiation between representatives of a union and employers (generally represented by management, or, in some countries such as Austria, Sweden and the Netherlands, by an employers' organization) in respect of the terms and conditions of employment of employees, such as wages, hours of work, working conditions, grievance procedures, and about the rights and responsibilities of trade unions. The parties often refer to the result of the negotiation as a collective bargaining agreement (CBA) or as a collective employment agreement (CEA).

Job Description for Actuary II

Actuary II utilizes statistical analysis and modeling to assess and manage risk and estimate financial outcomes. Compiles, prepares, and analyzes data to develop statistical models, probability tables, and actuarial studies and evaluate the likelihood and financial impact of various risks. Being an Actuary II assists with product design and development by analyzing risk groups and calculating appropriate insurance rates, premium levels, and rating systems and structures. Records and tracks accruals, claims, and settlements and prepares documents for input into regulatory filings, financial budgets, forecasts, and other financial projections. Additionally, Actuary II applies knowledge of mathematics, probability, statistics, principles of finance and business to calculations in life, health, social, and casualty insurance, annuities, and pensions. Requires a bachelor's degree. Must be currently pursuing the designation of ASA (Associate) in the Society of Actuaries. Typically reports to a manager. The Actuary II occasionally directed in several aspects of the work. Gaining exposure to some of the complex tasks within the job function. To be an Actuary II typically requires 2-4 years of related experience. (Copyright 2024 Salary.com)... View full job description

Search Job Openings

Salary.com job board provides millions of Actuary II information for you to search for. Click on search button below to see Actuary II job openings or enter a new job title here.

Career Path for Actuary II

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Actuary II, the upper level is Actuary III and then progresses to Actuary IV.

What does an Actuary II do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Actuary II Pay Difference by Location

Actuary II salary varies from city to city. Compared with national average salary of Actuary II, the highest Actuary II salary is in San Francisco, CA, where the Actuary II salary is 25.0% above. The lowest Actuary II salary is in Miami, FL, where the Actuary II salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Actuary II

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Actuary I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Actuary III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Actuary IV | Experience 7 + | EducationBachelors | Salary Compared to This Job |

| Job Title Actuary V | Experience 10 + | EducationBachelors | Salary Compared to This Job |

| Job Title Chemist II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

Level of Education for Actuary II

Jobs with different levels of education may pay very differently. Check the Actuary II salary of your education level.

Actuary II Salary by Global Country

Actuary II salary varies from country to country. There are several factors that mainly impact the Actuary II salary, including cost of living, economic conditions, market rates and legal differences. Click below to Actuary II salary of the other country.

Actuary II Salary by State

Geographic variations impact Actuary II salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Accounting Jobs by Salary Level

Browse Related Job Categories With Actuary II

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Actuary II salary varies from category to category. Click below to see Actuary II salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for an Actuary II, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Actuary II: Academic Focus: Mathematics, Statistics and Actuarial Modeling, Data Analysis, Insurance Software ...More

Recently searched related titles: Senior Actuarial Associate

Jobs with a similar salary range to Actuary II : Deputy Executive Director

Salary estimation for Actuary II at companies like : Nebraska PBL, California FIRST, S Holdings & Investments Inc

Jobs with a similar salary range to Actuary II : Actuarial Intern