Tax Accountant V Salary in Kansas

Tax Accountant V Salary in Kansas

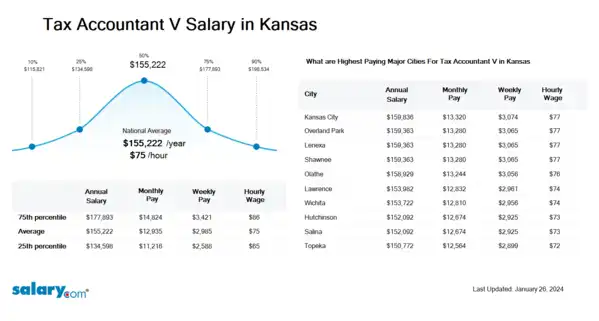

How much does a Tax Accountant V make in Kansas? The average Tax Accountant V salary in Kansas is $156,547 as of April 24, 2024, but the range typically falls between $135,742 and $179,422. Salary ranges can vary widely depending on the city and many other important factors, including education, certifications, additional skills, the number of years you have spent in your profession.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Tax Accountant V Salary | $116,801 | KS | April 24, 2024 |

| 25th Percentile Tax Accountant V Salary | $135,742 | KS | April 24, 2024 |

| 50th Percentile Tax Accountant V Salary | $156,547 | KS | April 24, 2024 |

| 75th Percentile Tax Accountant V Salary | $179,422 | KS | April 24, 2024 |

| 90th Percentile Tax Accountant V Salary | $200,249 | KS | April 24, 2024 |

- View Average Salary for United States

-

Select State

-

Select City in KS

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Kansas

What skills does a Tax Accountant V need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Bookkeeping: Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business. Transactions include purchases, sales, receipts, and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process. Bookkeeping is the work of a bookkeeper (or book-keeper), who records the day-to-day financial transactions of a business. They usually write the daybooks (which contain records of sales, purchases, receipts, and payments), and document each financial transaction, whether cash or credit, into the correct daybook—that is, petty cash book, suppliers ledger, customer ledger, etc.—and the general ledger. Thereafter, an accountant can create financial reports from the information recorded by the bookkeeper.

Tax Planning: Tax planning refers to financial planning for tax efficiency. It aims to reduce one's tax liabilities and optimally utilize tax exemptions, tax rebates, and benefits as much as possible. Tax planning includes making financial and business decisions to minimise the incidence of tax.

Job Description for Tax Accountant V

Tax Accountant V is responsible for the maintenance and preparation of tax records, tax returns, and tax-related schedules and reports. Prepares paperwork for local, state and federal level returns for submission within specified deadlines. Being a Tax Accountant V collects and analyzes changes in local, state and federal regulations to ensure work processes are in compliance with those changes. Requires a bachelor's degree in a related area. Additionally, Tax Accountant V typically reports to a manager. The Tax Accountant V works autonomously. Goals are generally communicated in "solution" or project goal terms. May provide a leadership role for the work group through knowledge in the area of specialization. Works on advanced, complex technical projects or business issues requiring state of the art technical or industry knowledge. To be a Tax Accountant V typically requires 10+ years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Tax Accountant V.

Search Job Openings

Salary.com job board provides millions of Tax Accountant V information for you to search for. Click on search button below to see Tax Accountant V job openings or enter a new job title here.

Select a city to view specific salary and bonus information for Tax Accountant V

| Location | Avg. Salary | Date Updated |

|---|---|---|

| Location Abbyville, KS | Avg. Salary $151,942 | Date Updated April 24, 2024 |

| Location Abilene, KS | Avg. Salary $151,120 | Date Updated April 24, 2024 |

| Location Admire, KS | Avg. Salary $150,462 | Date Updated April 24, 2024 |

| Location Agenda, KS | Avg. Salary $151,285 | Date Updated April 24, 2024 |

| Location Agra, KS | Avg. Salary $151,285 | Date Updated April 24, 2024 |

| Location Albert, KS | Avg. Salary $151,942 | Date Updated April 24, 2024 |

| Location Alden, KS | Avg. Salary $151,942 | Date Updated April 24, 2024 |

| Location Alexander, KS | Avg. Salary $151,942 | Date Updated April 24, 2024 |

| Location Allen, KS | Avg. Salary $150,462 | Date Updated April 24, 2024 |

| Location Alma, KS | Avg. Salary $150,462 | Date Updated April 24, 2024 |

Career Path for Tax Accountant V

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Tax Accountant V, the first career path typically progresses to Tax Research Manager.

Additionally, the second career path typically starts with a Tax Supervisor I position, and then progresses to Tax Supervisor II.

What does a Tax Accountant V do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

About Kansas

Similar Jobs to Tax Accountant V

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Accountant II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Accountant V | Experience 10 + | EducationBachelors | Salary Compared to This Job |

| Job Title Tax Accountant I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Tax Accountant II | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Tax Accountant III | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

Level of Education for Tax Accountant V

Jobs with different levels of education may pay very differently. Check the Tax Accountant V salary of your education level.

- Tax Accountant V Salaries with No Diploma

- Tax Accountant V Salaries with a High School Diploma or Technical Certificate

- Tax Accountant V Salaries with an Associate's Degree

- Tax Accountant V Salaries with a Bachelor's Degree

- Tax Accountant V Salaries with a Master's Degree or MBA

- Tax Accountant V Salaries with a JD, MD, PhD or Equivalent

View Salary Data for All Nearby Cities

Most Popular Cities for Tax Accountant V Job

- Houston, TX Tax Accountant V

- Philadelphia, PA Tax Accountant V

- Los Angeles, CA Tax Accountant V

- San Diego, CA Tax Accountant V

- San Antonio, TX Tax Accountant V

- New York, NY Tax Accountant V

- Dallas, TX Tax Accountant V

- Phoenix, AZ Tax Accountant V

- San Jose, CA Tax Accountant V

- Chicago, IL Tax Accountant V

Browse All Accounting Jobs by Salary Level

Browse Related Job Categories With Tax Accountant V

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Tax Accountant V salary varies from category to category. Click below to see Tax Accountant V salary in different categories.

About Kansas Kansas /ˈkænzəs/ (listen) is a U.S. state in the Midwestern United States. Its capital is Topeka and its largest city is Wichita, with its most popula....More

Skills associated with Tax Accountant V: GAAP Standards, Tax Preparation, Enterprise Tax Software, Tax Regulations ...More

Recently searched related titles: Property Tax Consultant

Salary estimation for Tax Accountant V at companies like : Madison County FitDance, Beatrice Community Hospital Hospice, Watchdata Technologies Usa Inc