Life Underwriting Supervisor Salary in the United States

Life Underwriting Supervisor Salary

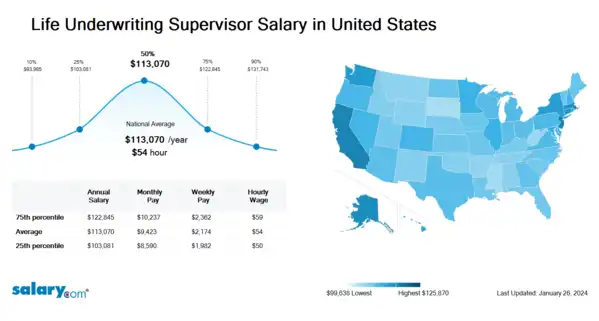

How much does a Life Underwriting Supervisor make in the United States? The average Life Underwriting Supervisor salary in the United States is $113,634 as of March 26, 2024, but the range typically falls between $103,598 and $123,453. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Life Underwriting Supervisor Salary | $94,459 | US | March 26, 2024 |

| 25th Percentile Life Underwriting Supervisor Salary | $103,598 | US | March 26, 2024 |

| 50th Percentile Life Underwriting Supervisor Salary | $113,634 | US | March 26, 2024 |

| 75th Percentile Life Underwriting Supervisor Salary | $123,453 | US | March 26, 2024 |

| 90th Percentile Life Underwriting Supervisor Salary | $132,393 | US | March 26, 2024 |

Therapeutic Behavioral Service Specialist

Bellefaire JCB - Akron, OH

Direct Support Professional - Classroom

SAW, Inc. - Beachwood, OH

CITIZENS NATIONAL BANK - Bluffton, OH

Environmental Services Technician

Wingspan Care Group - Cleveland, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

Job Description for Life Underwriting Supervisor

Life Underwriting Supervisor supervises group of underwriters who review, analyze and inspect life insurance contracts. Accepts, modifies or declines a risk through evaluation of an individual's medical history or physical condition, occupational hazards, financial background, insurable interest and other information. Being a Life Underwriting Supervisor analyzes various rate plans utilizing the organization's claims history to determine the appropriate rate plan and benefits costs. Familiar with current legislative and compliance processes affecting life insurance. Additionally, Life Underwriting Supervisor may evaluate reinstatements and changes in existing policies. May have designations or course work toward the CLU, FLMI, etc. Has a sound working knowledge of medical terminology. Requires a bachelor's degree. Typically reports to a manager or head of a unit/department. The Life Underwriting Supervisor supervises a small group of para-professional staff in an organization characterized by highly transactional or repetitive processes. Contributes to the development of processes and procedures. Thorough knowledge of functional area under supervision. To be a Life Underwriting Supervisor typically requires 3 years experience in the related area as an individual contributor. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Life Underwriting Supervisor.

Search Job Openings

Salary.com job board provides millions of Life Underwriting Supervisor information for you to search for. Click on search button below to see Life Underwriting Supervisor job openings or enter a new job title here.

Career Path for Life Underwriting Supervisor

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Life Underwriting Supervisor, the first career path typically starts with a Health Underwriting Manager position, and then Health Underwriting Director.

The second career path typically starts with a Life Underwriting Manager position, and then progresses to Life Underwriting Director.

The third career path typically starts with a Property Casualty Underwriting Manager position, and then progresses to Property Casualty Underwriting Director.

Additionally, the fourth career path typically starts with an Underwriting Supervisor position, and then progresses to Underwriting Manager.

What does a Life Underwriting Supervisor do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Life Underwriting Supervisor Pay Difference by Location

Life Underwriting Supervisor salary varies from city to city. Compared with national average salary of Life Underwriting Supervisor, the highest Life Underwriting Supervisor salary is in San Francisco, CA, where the Life Underwriting Supervisor salary is 25.0% above. The lowest Life Underwriting Supervisor salary is in Miami, FL, where the Life Underwriting Supervisor salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Life Underwriting Supervisor

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Life Underwriting Director | Experience | EducationBachelors | Salary Compared to This Job |

| Job Title Life Underwriting Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Property Casualty Underwriting Supervisor | Experience 3 + | EducationBachelors | Salary Compared to This Job |

| Job Title Top Life Underwriting Executive | Experience | EducationBachelors | Salary Compared to This Job |

| Job Title Underwriter (Life) I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

Level of Education for Life Underwriting Supervisor

Jobs with different levels of education may pay very differently. Check the Life Underwriting Supervisor salary of your education level.

Life Underwriting Supervisor Salary by State

Geographic variations impact Life Underwriting Supervisor salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Insurance Jobs by Salary Level

Browse Related Job Categories With Life Underwriting Supervisor

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Life Underwriting Supervisor salary varies from category to category. Click below to see Life Underwriting Supervisor salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Life Underwriting Supervisor, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Life Underwriting Supervisor: Underwriting, Underwriting & Rating Software, Denial Administration, Calculate Ratings ...More

Salary estimation for Life Underwriting Supervisor at companies like : Metropolis Los Angeles, Sisters Planning Department, Foundations for Education Inc

Jobs with a similar salary range to Life Underwriting Supervisor : Silicon Engineer