Credit Card Operations Clerk Salary in the United States

Credit Card Operations Clerk Salary

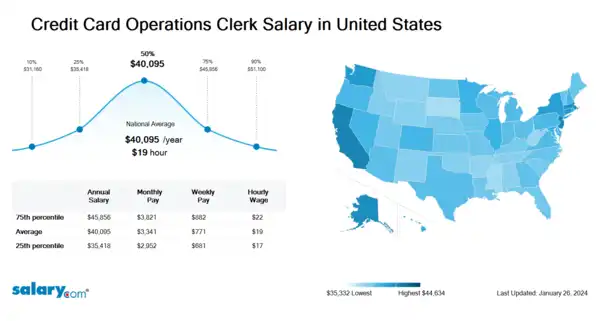

How much does a Credit Card Operations Clerk make in the United States? The average Credit Card Operations Clerk salary in the United States is $40,265 as of March 26, 2024, but the range typically falls between $35,569 and $46,053. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Credit Card Operations Clerk Salary | $31,293 | US | March 26, 2024 |

| 25th Percentile Credit Card Operations Clerk Salary | $35,569 | US | March 26, 2024 |

| 50th Percentile Credit Card Operations Clerk Salary | $40,265 | US | March 26, 2024 |

| 75th Percentile Credit Card Operations Clerk Salary | $46,053 | US | March 26, 2024 |

| 90th Percentile Credit Card Operations Clerk Salary | $51,323 | US | March 26, 2024 |

PrideStaff - Barberton, OH

Acloche - Bucyrus, OH

Coast Guard Exchange - Cleveland, OH

Night Audit -Desk Clerk-Full Time-Holiday Inn Exp Cleveland, OH

Holiday Inn Express Cleveland Downtown, OH - Cleveland, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Credit Card Operations Clerk need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Background Check: A background check or background investigation is a review of a potential employee's criminal, commercial and financial records. The goal of background checks is to ensure the safety and security of the employees in the organisation

Fraud Investigation: A fraud investigation is conducted with the intention to protect and offer justice to the victim of a fraudulent offence, and in turn to punish the fraudster responsible for the offence.

Job Description for Credit Card Operations Clerk

Credit Card Operations Clerk controls the issuance and renewal of credit cards by the organization. Maintains inventory of blank cards and sends cards to be imprinted as needed. Being a Credit Card Operations Clerk verifies names and account numbers on cards and mails completed cards to customers. May require a high school diploma or its equivalent. Additionally, Credit Card Operations Clerk typically reports to a supervisor. The Credit Card Operations Clerk possesses a moderate understanding of general aspects of the job. Works under the close direction of senior personnel in the functional area. May require 0-1 year of general work experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Credit Card Operations Clerk.

Search Job Openings

Salary.com job board provides millions of Credit Card Operations Clerk information for you to search for. Click on search button below to see Credit Card Operations Clerk job openings or enter a new job title here.

Career Path for Credit Card Operations Clerk

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Credit Card Operations Clerk, the upper level is Credit Card Operations Clerk, Sr. and then progresses to Credit Card Operations Supervisor.

What does a Credit Card Operations Clerk do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Credit Card Operations Clerk Pay Difference by Location

Credit Card Operations Clerk salary varies from city to city. Compared with national average salary of Credit Card Operations Clerk, the highest Credit Card Operations Clerk salary is in San Francisco, CA, where the Credit Card Operations Clerk salary is 25.0% above. The lowest Credit Card Operations Clerk salary is in Miami, FL, where the Credit Card Operations Clerk salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Credit Card Operations Clerk

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Credit Card Fraud Investigator | Experience 2 - 4 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Card Operations Clerk, Sr. | Experience 1 - 3 | EducationHigh School | Salary Compared to This Job |

| Job Title Credit Card Operations Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Card Operations Supervisor | Experience 3 + | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Card Product Manager | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

Level of Education for Credit Card Operations Clerk

Jobs with different levels of education may pay very differently. Check the Credit Card Operations Clerk salary of your education level.

Credit Card Operations Clerk Salary by State

Geographic variations impact Credit Card Operations Clerk salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Credit Card Operations Clerk

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Credit Card Operations Clerk salary varies from category to category. Click below to see Credit Card Operations Clerk salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Credit Card Operations Clerk, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Credit Card Operations Clerk: Data Entry-Keyboarding, Data Control, Mailing Fulfillment, Payment Processing

Recently searched related titles: Credit Card Processor, Armored Service Technician, Head Veterinary Technician

Jobs with a similar salary range to Credit Card Operations Clerk : Trainee Dispensing Optician, Card Services Representative

Salary estimation for Credit Card Operations Clerk at companies like : Ljl Industries LLC, IRA Services Trust Company CFBO Maria Mayer TRAD IRA, All American Industries LLC

Jobs with a similar salary range to Credit Card Operations Clerk : Teacher Extension Work, Collection Executive, First Year Electrical Apprentice