Credit Risk Officer I Salary in the United States

Credit Risk Officer I Salary

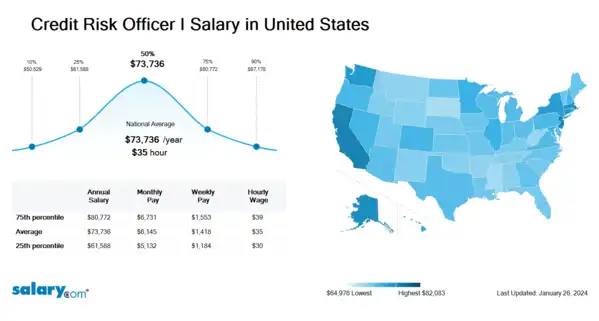

How much does a Credit Risk Officer I make in the United States? The average Credit Risk Officer I salary in the United States is $74,047 as of March 26, 2024, but the range typically falls between $61,851 and $81,115. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Credit Risk Officer I Salary | $50,748 | US | March 26, 2024 |

| 25th Percentile Credit Risk Officer I Salary | $61,851 | US | March 26, 2024 |

| 50th Percentile Credit Risk Officer I Salary | $74,047 | US | March 26, 2024 |

| 75th Percentile Credit Risk Officer I Salary | $81,115 | US | March 26, 2024 |

| 90th Percentile Credit Risk Officer I Salary | $87,550 | US | March 26, 2024 |

Teller/Member Service Representative I - Part Time

Cincinnati Police Federal Credit Union - Cincinnati, OH

Goosehead Insurance Agency - Cincinnati, OH

Senior Manager, Enterprise Risk Management

First Merchants Bank - Columbus, OH

M/I Homes, Inc. - Columbus, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Credit Risk Officer I need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Risk Management: Risk management is the identification, evaluation, and prioritization of risks (defined in ISO 31000 as the effect of uncertainty on objectives) followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events or to maximize the realization of opportunities. Risks can come from various sources including uncertainty in financial markets, threats from project failures (at any phase in design, development, production, or sustainment life-cycles), legal liabilities, credit risk, accidents, natural causes and disasters, deliberate attack from an adversary, or events of uncertain or unpredictable root-cause. There are two types of events i.e. negative events can be classified as risks while positive events are classified as opportunities. Several risk management standards have been developed including the Project Management Institute, the National Institute of Standards and Technology, actuarial societies, and ISO standards. Methods, definitions and goals vary widely according to whether the risk management method is in the context of project management, security, engineering, industrial processes, financial portfolios, actuarial assessments, or public health and safety.

Financial Statements: Obtaining and creating formal records of business activities and cash flows to provide results for financial performance.

Accounting: Creating financial statements and reports based on the summary of financial and business transactions.

Job Description for Credit Risk Officer I

Credit Risk Officer I provides analysis and evaluation in order to reduce credit risk for a financial institution. Extracts data from a variety of sources and uses data to build simple to moderately complex financial models that predict risk exposure. Being a Credit Risk Officer I prepares performance reports for management. Requires a bachelor's degree. Additionally, Credit Risk Officer I typically reports to a supervisor or manager. The Credit Risk Officer I works on projects/matters of limited complexity in a support role. Work is closely managed. To be a Credit Risk Officer I typically requires 0-2 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Credit Risk Officer I.

Search Job Openings

Salary.com job board provides millions of Credit Risk Officer I information for you to search for. Click on search button below to see Credit Risk Officer I job openings or enter a new job title here.

Career Path for Credit Risk Officer I

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Credit Risk Officer I, the first career path typically progresses to Letter of Credit Officer.

Additionally, the second career path typically starts with a Credit Risk Officer II position, and then progresses to Credit Risk Manager.

What does a Credit Risk Officer I do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Credit Risk Officer I Pay Difference by Location

Credit Risk Officer I salary varies from city to city. Compared with national average salary of Credit Risk Officer I, the highest Credit Risk Officer I salary is in San Francisco, CA, where the Credit Risk Officer I salary is 25.0% above. The lowest Credit Risk Officer I salary is in Miami, FL, where the Credit Risk Officer I salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Credit Risk Officer I

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Credit Analysis Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Credit Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Analyst I | Experience 0 - 2 | EducationBachelors | Salary Compared to This Job |

| Job Title Credit and Collections Representative I | Experience 0 - 1 | EducationHigh School | Salary Compared to This Job |

| Job Title Credit Risk Manager | Experience 5 + | EducationMasters | Salary Compared to This Job |

Level of Education for Credit Risk Officer I

Jobs with different levels of education may pay very differently. Check the Credit Risk Officer I salary of your education level.

Credit Risk Officer I Salary by Global Country

Credit Risk Officer I salary varies from country to country. There are several factors that mainly impact the Credit Risk Officer I salary, including cost of living, economic conditions, market rates and legal differences. Click below to Credit Risk Officer I salary of the other country.

Credit Risk Officer I Salary by State

Geographic variations impact Credit Risk Officer I salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Credit Risk Officer I

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Credit Risk Officer I salary varies from category to category. Click below to see Credit Risk Officer I salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Credit Risk Officer I, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Credit Risk Officer I: Risk Identification Model, Risk Analysis, Financial Risk Management Software, Financial Modeling ...More

Recently searched related titles: ASP Programmer, Chief Electrical Inspector, Credit Risk Analyst

Jobs with a similar salary range to Credit Risk Officer I : Credit Risk Consultant, Risk Officer, Credit Risk Specialist, Small Business Credit Analyst

Salary estimation for Credit Risk Officer I at companies like : Barleys Casino Brewing Co, Bayou Lafourche Area Convention, PIA Partnership companies

Jobs with a similar salary range to Credit Risk Officer I : Homeland Security, Regional Operations