Leasing Consultant, Sr. Salary in the United States

Leasing Consultant, Sr. Salary

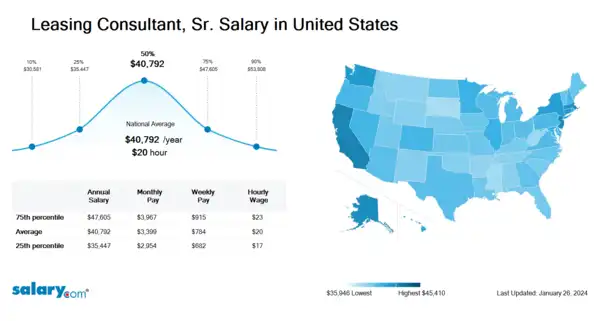

How much does a Leasing Consultant, Sr. make in the United States? The average Leasing Consultant, Sr. salary in the United States is $41,322 as of June 27, 2024, but the range typically falls between $35,909 and $48,221. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Leasing Consultant, Sr. Salary | $30,982 | US | June 27, 2024 |

| 25th Percentile Leasing Consultant, Sr. Salary | $35,909 | US | June 27, 2024 |

| 50th Percentile Leasing Consultant, Sr. Salary | $41,322 | US | June 27, 2024 |

| 75th Percentile Leasing Consultant, Sr. Salary | $48,221 | US | June 27, 2024 |

| 90th Percentile Leasing Consultant, Sr. Salary | $54,503 | US | June 27, 2024 |

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Leasing Consultant, Sr. need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Customer Service: Customer service is the provision of service to customers before, during and after a purchase. The perception of success of such interactions is dependent on employees "who can adjust themselves to the personality of the guest". Customer service concerns the priority an organization assigns to customer service relative to components such as product innovation and pricing. In this sense, an organization that values good customer service may spend more money in training employees than the average organization or may proactively interview customers for feedback. From the point of view of an overall sales process engineering effort, customer service plays an important role in an organization's ability to generate income and revenue. From that perspective, customer service should be included as part of an overall approach to systematic improvement. One good customer service experience can change the entire perception a customer holds towards the organization.

Bookkeeping: Bookkeeping is the recording of financial transactions, and is part of the process of accounting in business. Transactions include purchases, sales, receipts, and payments by an individual person or an organization/corporation. There are several standard methods of bookkeeping, including the single-entry and double-entry bookkeeping systems. While these may be viewed as "real" bookkeeping, any process for recording financial transactions is a bookkeeping process. Bookkeeping is the work of a bookkeeper (or book-keeper), who records the day-to-day financial transactions of a business. They usually write the daybooks (which contain records of sales, purchases, receipts, and payments), and document each financial transaction, whether cash or credit, into the correct daybook—that is, petty cash book, suppliers ledger, customer ledger, etc.—and the general ledger. Thereafter, an accountant can create financial reports from the information recorded by the bookkeeper.

Account Reconciliation: Account Reconcilation is the process of ensuring internal financial records to external spending.

What Should I Pay?

Job Description for Leasing Consultant, Sr.

Leasing Consultant, Sr. facilitates the rental of apartment units to ensure maximum occupancy at all times and high renewal rates. Coordinates move-ins and move-outs, lease negotiations and renewals, and apartment showings. Being a Leasing Consultant, Sr. ensures paperwork of current and prospective tenants is completed accurately. May require an associate degree. Additionally, Leasing Consultant, Sr. typically reports to a manager. The Leasing Consultant, Sr. works independently within established procedures associated with the specific job function. Has gained proficiency in multiple competencies relevant to the job. To be a Leasing Consultant, Sr. typically requires 3-5 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Leasing Consultant, Sr..

Search Job Openings

Salary.com job board provides millions of Leasing Consultant, Sr. information for you to search for. Click on search button below to see Leasing Consultant, Sr. job openings or enter a new job title here.

Career Path for Leasing Consultant, Sr.

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Leasing Consultant, Sr., the first career path typically starts with a Leasing Manager position, and then progresses to Leasing Administration Manager.

Additionally, the second career path typically progresses to Commercial Leasing Manager.

What does a Leasing Consultant, Sr. do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Leasing Consultant, Sr. Pay Difference by Location

Leasing Consultant, Sr. salary varies from city to city. Compared with national average salary of Leasing Consultant, Sr., the highest Leasing Consultant, Sr. salary is in San Francisco, CA, where the Leasing Consultant, Sr. salary is 25.0% above. The lowest Leasing Consultant, Sr. salary is in Miami, FL, where the Leasing Consultant, Sr. salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Level of Education for Leasing Consultant, Sr.

Jobs with different levels of education may pay very differently. Check the Leasing Consultant, Sr. salary of your education level.

- Leasing Consultant, Sr. Salaries with a High School Diploma or Technical Certificate

- Leasing Consultant, Sr. Salaries with an Associate's Degree

- Leasing Consultant, Sr. Salaries with a Bachelor's Degree

- Leasing Consultant, Sr. Salaries with a Master's Degree or MBA

- Leasing Consultant, Sr. Salaries with a JD, MD, PhD or Equivalent

Leasing Consultant, Sr. Salary by State

Geographic variations impact Leasing Consultant, Sr. salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Real Estate Jobs by Salary Level

Browse Related Job Categories With Leasing Consultant, Sr.

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Leasing Consultant, Sr. salary varies from category to category. Click below to see Leasing Consultant, Sr. salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Leasing Consultant, Sr., base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Leasing Consultant, Sr.: Customer Communications, Negotiation, Scheduling, Document Preparation ...More

Recently searched related titles: General Liability Adjuster

Jobs with a similar salary range to Leasing Consultant, Sr. : Marine Adjuster, Leasing Coordinator, Leasing Specialist

Salary estimation for Leasing Consultant, Sr. at companies like : GreenHouse Holdings Inc, E P M Corp, Elmore & Wall

Jobs with a similar salary range to Leasing Consultant, Sr. : Elevator Adjuster, Medical Adjuster, Subrogation Claims Adjuster