Personal Banking Manager Salary in the United States

Personal Banking Manager Salary

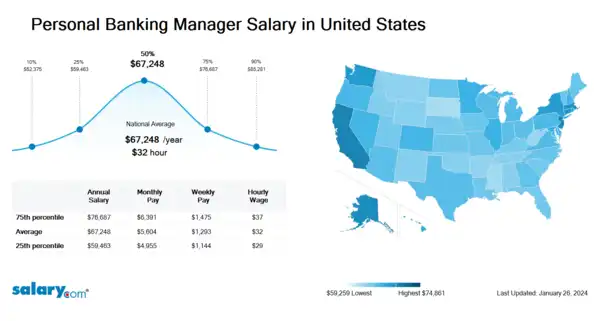

How much does a Personal Banking Manager make in the United States? The average Personal Banking Manager salary in the United States is $67,523 as of March 26, 2024, but the range typically falls between $59,706 and $77,010. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Personal Banking Manager Salary | $52,589 | US | March 26, 2024 |

| 25th Percentile Personal Banking Manager Salary | $59,706 | US | March 26, 2024 |

| 50th Percentile Personal Banking Manager Salary | $67,523 | US | March 26, 2024 |

| 75th Percentile Personal Banking Manager Salary | $77,010 | US | March 26, 2024 |

| 90th Percentile Personal Banking Manager Salary | $85,648 | US | March 26, 2024 |

Walnut Ridge - Beachwood, OH

First National Bank - Bellevue, OH

Heartland Bank - Columbus, OH

Sutton Bank - Columbus, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Personal Banking Manager need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Coaching: Coaching is a form of development in which an experienced person, called a coach, supports a learner or client in achieving a specific personal or professional goal by providing training and guidance.

Cash Handling: Process of receiving and giving money in a business. In retail, cash handling ranges from the point of sale to the behind-the-scenes money management during the day.

Retail Banking: Retail banking, also known as consumer banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking. Banking services which are regarded as retail include provision of savings and transactional accounts, mortgages, personal loans, debit cards, and credit cards. Retail banking is also distinguished from investment banking or commercial banking. It may also refer to a division or department of a bank which deals with individual customers. In the U.S., the term commercial bank is used for a normal bank to distinguish it from an investment bank. After the Great Depression, the Glass–Steagall Act restricted normal banks to banking activities, and investment banks were limited to engaging capital market activities. That distinction was repealed in the 1990s. Commercial bank can also refer to a bank or a division of a bank that deals mostly with deposits and loans from corporations or large businesses, as opposed to individual members of the public (retail banking).

Job Description for Personal Banking Manager

Personal Banking Manager manages personal banking staff and daily operations to ensure customer satisfaction and develop client relationships. Focuses teams on identifying customer needs and maintaining up-to-date knowledge of all bank products and services to explain, promote, and cross-sell products and services. Being a Personal Banking Manager ensures efficient processing of basic branch service transactions and accurate referrals to enable customers to access the right resource to facilitate other banking requests easily. Develops processes that enable staff to provide rapid research and solutions to account issues, answers to customer inquiries, and effective education and training on banking self-service technology. Additionally, Personal Banking Manager requires a bachelor's degree. Typically reports to a director. The Personal Banking Manager supervises a group of primarily para-professional level staffs. May also be a level above a supervisor within high volume administrative/ production environments. Makes day-to-day decisions within or for a group/small department. Has some authority for personnel actions. To be a Personal Banking Manager typically requires 3-5 years experience in the related area as an individual contributor. Thorough knowledge of functional area and department processes. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Personal Banking Manager.

Search Job Openings

Salary.com job board provides millions of Personal Banking Manager information for you to search for. Click on search button below to see Personal Banking Manager job openings or enter a new job title here.

What does a Personal Banking Manager do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Personal Banking Manager Pay Difference by Location

Personal Banking Manager salary varies from city to city. Compared with national average salary of Personal Banking Manager, the highest Personal Banking Manager salary is in San Francisco, CA, where the Personal Banking Manager salary is 25.0% above. The lowest Personal Banking Manager salary is in Miami, FL, where the Personal Banking Manager salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Personal Banking Manager

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Assistant Branch Manager II | Experience 3 - 5 | EducationBachelors | Salary Compared to This Job |

| Job Title Banking Product Manager | Experience 4 - 7 | EducationBachelors | Salary Compared to This Job |

| Job Title Banking Strategic Development Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Business Banking Manager I | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title International Banking Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

Level of Education for Personal Banking Manager

Jobs with different levels of education may pay very differently. Check the Personal Banking Manager salary of your education level.

Personal Banking Manager Salary by State

Geographic variations impact Personal Banking Manager salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Personal Banking Manager

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Personal Banking Manager salary varies from category to category. Click below to see Personal Banking Manager salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Personal Banking Manager, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Personal Banking Manager: Develop Referrals, Customer Relationship Management (CRM), Inquiry Research/Response, Banking Software ...More

Recently searched related titles: Client Manager

Jobs with a similar salary range to Personal Banking Manager : OEM Sales Account Manage

Salary estimation for Personal Banking Manager at companies like : Gundersen Palmer Hospital, W Marshall Holdings LLC, Devine Tarbell & Associates