Mortgage Collection Supervisor II Salary in the United States

Mortgage Collection Supervisor II Salary

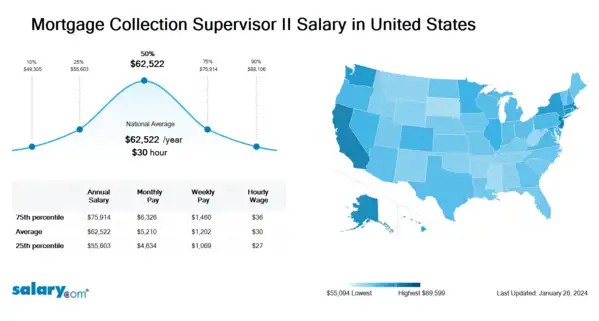

How much does a Mortgage Collection Supervisor II make in the United States? The average Mortgage Collection Supervisor II salary in the United States is $62,806 as of March 26, 2024, but the range typically falls between $55,849 and $76,254. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Mortgage Collection Supervisor II Salary | $49,516 | US | March 26, 2024 |

| 25th Percentile Mortgage Collection Supervisor II Salary | $55,849 | US | March 26, 2024 |

| 50th Percentile Mortgage Collection Supervisor II Salary | $62,806 | US | March 26, 2024 |

| 75th Percentile Mortgage Collection Supervisor II Salary | $76,254 | US | March 26, 2024 |

| 90th Percentile Mortgage Collection Supervisor II Salary | $88,498 | US | March 26, 2024 |

Medical Assistant I: Perianesthesia - $2,000 Sign on bonus offered

CHILDRENS HOSPITAL MEDICAL CENTER OF AKRON - Akron, OH

New American Funding - Broadview Heights, OH

Commercial Relationship Manager Team Lead

Heartland Bank - Cincinnati, OH

Oak Street Health - Cleveland, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Mortgage Collection Supervisor II need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Budgeting: Applying specific policies, tools and practices to plan and prepare projected revenues, expenses, cash flows, and capital expenditures.

Continuous Improvement: A continual improvement process, also often called a continuous improvement process (abbreviated as CIP or CI), is an ongoing effort to improve products, services, or processes. These efforts can seek "incremental" improvement over time or "breakthrough" improvement all at once. Delivery (customer valued) processes are constantly evaluated and improved in the light of their efficiency, effectiveness and flexibility. Some see CIPs as a meta-process for most management systems (such as business process management, quality management, project management, and program management). W. Edwards Deming, a pioneer of the field, saw it as part of the 'system' whereby feedback from the process and customer were evaluated against organisational goals. The fact that it can be called a management process does not mean that it needs to be executed by 'management'; but rather merely that it makes decisions about the implementation of the delivery process and the design of the delivery process itself.

Microsoft Office: Microsoft Office is a suite of desktop productivity applications that is designed by Microsoft for business use. You can create documents containing text and images, work with data in spreadsheets and databases, create presentations and posters.

Job Description for Mortgage Collection Supervisor II

Mortgage Collection Supervisor II supervises a team of collectors who limit collection portfolio losses and delinquencies. Oversees collections procedures to ensure compliance with all policies and procedures. Being a Mortgage Collection Supervisor II evaluates past-due accounts for accuracy. Provides reports to management with recommendations for improvement and referrals of complex accounts. Additionally, Mortgage Collection Supervisor II may require a bachelor's degree. Typically reports to a manager or head of a unit/department. The Mortgage Collection Supervisor II supervises a group of primarily para-professional level staffs. May also be a level above a supervisor within high volume administrative/ production environments. Makes day-to-day decisions within or for a group/small department. Has some authority for personnel actions. Thorough knowledge of department processes. To be a Mortgage Collection Supervisor II typically requires 3-5 years experience in the related area as an individual contributor. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Mortgage Collection Supervisor II.

Search Job Openings

Salary.com job board provides millions of Mortgage Collection Supervisor II information for you to search for. Click on search button below to see Mortgage Collection Supervisor II job openings or enter a new job title here.

Career Path for Mortgage Collection Supervisor II

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Mortgage Collection Supervisor II, the first career path typically progresses to Consumer Loan Collection Manager.

The second career path typically progresses to Consumer Loan Collection/Recovery Manager.

Additionally, the third career path typically progresses to Mortgage Collection Manager.

What does a Mortgage Collection Supervisor II do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Mortgage Collection Supervisor II Pay Difference by Location

Mortgage Collection Supervisor II salary varies from city to city. Compared with national average salary of Mortgage Collection Supervisor II, the highest Mortgage Collection Supervisor II salary is in San Francisco, CA, where the Mortgage Collection Supervisor II salary is 25.0% above. The lowest Mortgage Collection Supervisor II salary is in Miami, FL, where the Mortgage Collection Supervisor II salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Mortgage Collection Supervisor II

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Consumer Loan Collection Supervisor II | Experience 3 - 5 | EducationBachelors | Salary Compared to This Job |

| Job Title Loan Collection Clerk II | Experience 1 - 3 | EducationHigh School | Salary Compared to This Job |

| Job Title Mortgage Collection Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Collection Supervisor I | Experience 3 + | EducationBachelors | Salary Compared to This Job |

| Job Title Mortgage Collector II | Experience 1 - 3 | EducationHigh School | Salary Compared to This Job |

Level of Education for Mortgage Collection Supervisor II

Jobs with different levels of education may pay very differently. Check the Mortgage Collection Supervisor II salary of your education level.

- Mortgage Collection Supervisor II Salaries with a High School Diploma or Technical Certificate

- Mortgage Collection Supervisor II Salaries with an Associate's Degree

- Mortgage Collection Supervisor II Salaries with a Bachelor's Degree

- Mortgage Collection Supervisor II Salaries with a Master's Degree or MBA

- Mortgage Collection Supervisor II Salaries with a JD, MD, PhD or Equivalent

Mortgage Collection Supervisor II Salary by State

Geographic variations impact Mortgage Collection Supervisor II salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Mortgage Collection Supervisor II

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Mortgage Collection Supervisor II salary varies from category to category. Click below to see Mortgage Collection Supervisor II salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Mortgage Collection Supervisor II, base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Mortgage Collection Supervisor II: Banking Software, Credit and Collections Software, Loan Collections

Jobs with a similar salary range to Mortgage Collection Supervisor II : Credit Analyst Trainee

Salary estimation for Mortgage Collection Supervisor II at companies like : NRH/ CPT/ ST.MARY/ CIVISTA REGIONAL REHABILITATION Inc, 1M&T Bank, Center for Healthcare Quality and Analytics