Relationship Manager III (Business Banking) Salary in the United States

Relationship Manager III (Business Banking) Salary

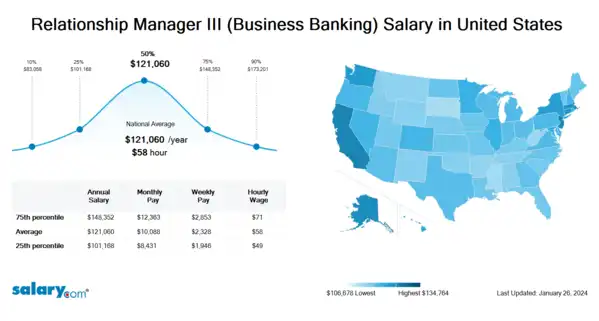

How much does a Relationship Manager III (Business Banking) make in the United States? The average Relationship Manager III (Business Banking) salary in the United States is $121,672 as of March 26, 2024, but the range typically falls between $101,677 and $149,086. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

| Percentile | Salary | Location | Last Updated |

| 10th Percentile Relationship Manager III (Business Banking) Salary | $83,473 | US | March 26, 2024 |

| 25th Percentile Relationship Manager III (Business Banking) Salary | $101,677 | US | March 26, 2024 |

| 50th Percentile Relationship Manager III (Business Banking) Salary | $121,672 | US | March 26, 2024 |

| 75th Percentile Relationship Manager III (Business Banking) Salary | $149,086 | US | March 26, 2024 |

| 90th Percentile Relationship Manager III (Business Banking) Salary | $174,046 | US | March 26, 2024 |

Business Operations Manager (3+ yrs of Mfg exp. req. $70-85K)

#twiceasnice Recruiting - Akron, OH

Commercial Relationship Manager Team Lead

Heartland Bank - Cincinnati, OH

Banking as a Service (BaaS) Relationship Manager - (Hybrid/Remote)

Emprise Bank - Cleveland, OH

Huntington National Bank - Columbus, OH

- View Hourly Wages

-

Select State

-

Select City

-

Choose Similar Job

-

Pick Related Category

- View Cost of Living in Major Cities

What skills does a Relationship Manager III (Business Banking) need?

Each competency has five to ten behavioral assertions that can be observed, each with a corresponding performance level (from one to five) that is required for a particular job.

Coaching: Coaching is a form of development in which an experienced person, called a coach, supports a learner or client in achieving a specific personal or professional goal by providing training and guidance.

Prospecting: Prospecting is the first stage of the geological analysis (second – exploration) of a territory. It is the physical search for minerals, fossils, precious metals or mineral specimens, and is also known as fossicking. Prospecting is a small-scale form of mineral exploration which is an organised, large scale effort undertaken by commercial mineral companies to find commercially viable ore deposits. Prospecting is physical labour, involving traversing (traditionally on foot or on horseback), panning, sifting and outcrop investigation, looking for signs of mineralisation. In some areas a prospector must also make claims, meaning they must erect posts with the appropriate placards on all four corners of a desired land they wish to prospect and register this claim before they may take samples. In other areas publicly held lands are open to prospecting without staking a mining claim.

Credit Products: Credit Product means a charge or credit card or program, an on-line or mobile credit or charge account, or other credit or charge device.

Job Description for Relationship Manager III (Business Banking)

Relationship Manager III (Business Banking) manages, maintains, and grows current business banking relationships and develops new customers. Responsible for a portfolio of large businesses. Being a Relationship Manager III (Business Banking) seeks cross-sell opportunities and directs customers to other services and products available to meet their needs and generate business. Requires a bachelor's degree. Additionally, Relationship Manager III (Business Banking) typically reports to a manager or head of a unit/department. The Relationship Manager III (Business Banking) contributes to moderately complex aspects of a project. Work is generally independent and collaborative in nature. To be a Relationship Manager III (Business Banking) typically requires 4 to 7 years of related experience. (Copyright 2024 Salary.com)... View full job description

See user submitted job responsibilities for Relationship Manager III (Business Banking).

Search Job Openings

Salary.com job board provides millions of Relationship Manager III (Business Banking) information for you to search for. Click on search button below to see Relationship Manager III (Business Banking) job openings or enter a new job title here.

Career Path for Relationship Manager III (Business Banking)

A career path is a sequence of jobs that leads to your short- and long-term career goals. Some follow a linear career path within one field, while others change fields periodically to achieve career or personal goals.

For Relationship Manager III (Business Banking), the upper level is Relationship Manager IV (Business Banking) and then progresses to Business Banking Manager I.

What does a Relationship Manager III (Business Banking) do?

Are you an HR manager or compensation specialist?

Salary.com's CompAnalyst platform offers:

- Detailed skills and competency reports for specific positions

- Job and employee pricing reports

- Compensation data tools, salary structures, surveys and benchmarks.

Relationship Manager III (Business Banking) Pay Difference by Location

Relationship Manager III (Business Banking) salary varies from city to city. Compared with national average salary of Relationship Manager III (Business Banking), the highest Relationship Manager III (Business Banking) salary is in San Francisco, CA, where the Relationship Manager III (Business Banking) salary is 25.0% above. The lowest Relationship Manager III (Business Banking) salary is in Miami, FL, where the Relationship Manager III (Business Banking) salary is 3.5% lower than national average salary.

| City, State | Compared to national average |

|---|---|

| City, State San Francisco, CA |

Compared to national average

|

| City, State Washington, DC |

Compared to national average

|

| City, State Miami, FL |

Compared to national average

|

| City, State Chicago, IL |

Compared to national average

|

| City, State Boston, MA |

Compared to national average

|

| City, State New York, NY |

Compared to national average

|

| City, State Dallas, TX |

Compared to national average

|

Similar Jobs to Relationship Manager III (Business Banking)

| Job Title | Experience | EDUCATION | Salary Compared to This Job |

|---|---|---|---|

| Job Title Business Banking Manager I | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Business Banking Manager II | Experience | EducationBachelors | Salary Compared to This Job |

| Job Title Business Intelligence Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title Business Process Optimization Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

| Job Title ERP Business Analysis Manager | Experience 5 + | EducationBachelors | Salary Compared to This Job |

Level of Education for Relationship Manager III (Business Banking)

Jobs with different levels of education may pay very differently. Check the Relationship Manager III (Business Banking) salary of your education level.

Relationship Manager III (Business Banking) Salary by State

Geographic variations impact Relationship Manager III (Business Banking) salary levels, due to various factors, such as cost of living, industries, market demand and company budgets. Click below to see pay differences between states.

Browse All Banking Jobs by Salary Level

Browse Related Job Categories With Relationship Manager III (Business Banking)

A job category is a classification or grouping of job positions that share similar characteristics, functions, or industries. Relationship Manager III (Business Banking) salary varies from category to category. Click below to see Relationship Manager III (Business Banking) salary in different categories.

Take just three simple steps below to generate your own personalized salary report

Understand the total compensation opportunity for a Relationship Manager III (Business Banking), base salary plus other pay elements

Average Base Salary

Core compensation

Average Total Cash Compensation

Includes base and annual incentives

View the Cost of Living in Major Cities

Skills associated with Relationship Manager III (Business Banking): Customer Relationship Management (CRM) software, Account Management, Customer Relationship Management (CRM), Cross-Selling ...More

Recently searched related titles: Drilling Rig Manager, Vice President Relationship Manager, Treasury Relationship Manager

Jobs with a similar salary range to Relationship Manager III (Business Banking) : Senior Relationship Manager, Senior Business Relationship Manager

Salary estimation for Relationship Manager III (Business Banking) at companies like : Trenton Metro Area Local, EBTF Holdings Inc, Nissan Motor Manufacturing Corp

Jobs with a similar salary range to Relationship Manager III (Business Banking) : Accenture Manager