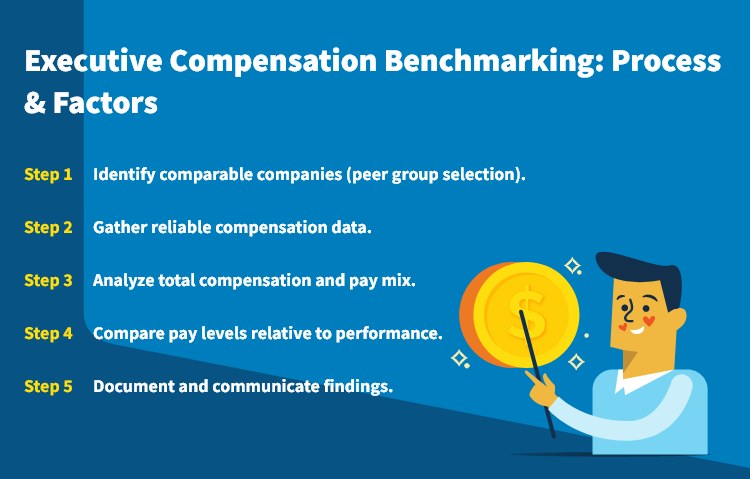

Executive Compensation Benchmarking: Process & Factors

- Step 1. Identify comparable companies (peer group selection).

- Step 2. Gather reliable compensation data.

- Step 3. Analyze total compensation and pay mix.

- Step 4. Compare pay levels relative to performance.

- Step 5. Document and communicate findings.

Executive compensation benchmarking evaluates and compares executive pay against industry standards to keep it competitive. Reports show that executive compensation increased in 2024, according to U.S. Securities and Exchange Commission filings.

Without the right benchmarking, companies may pay executives too much or too little, which causes retention issues and misalignment with the market. This guide explains executive compensation benchmarking and key factors to consider when implementing it.

What is executive compensation?

Executive compensation refers to the pay that senior-level executives receive for their work and service. A typical executive compensation package often includes financial and non-financial components, such as:

Base salary,

bonuses or cash incentives

stock options,

restricted stock units (RSUs)

long term incentives

performance-based awards

retirement benefits/pensions, and

executive perks and benefits (also known as hidden compensation).

For example, for 2023, Jon Winkelried of TPG Inc. had the highest recorded CEO salary in the United States, with a total compensation of $198,685,926, which included base salary and the value of stock.

Over the past 10 years, the average CEO pay at S&P 500 companies has increased by more than $4 million, reaching $17.7 million in 2023. Executive pay is not determined arbitrarily; it is often based on benchmarking against market data.

In discussions about executive compensation benchmarking, HR professionals have identified the availability of reliable data as the biggest challenge. To address this, many organizations rely on trusted compensation data tools to benchmark executive pay accurately and equitably.

For example, Salary.com's national benchmark survey provides access to executive and general staff compensation data from more than 2,600 organizations across industries. This executive compensation survey data helps companies set fair and competitive pay.

Key components of executive pay

According to Angela Bailey, the VP of Compensation Consulting at Salary.com, there are three key components of executive pay that every HR professional needs to know:

-

Pay ratios

Pay ratios compare executive pay to employee pay. Companies use them to assess fairness and benchmark against industry standards. The CEO-to-median employee pay ratio is a common metric, especially for public companies.

A high ratio may signal a large pay gap

A lower ratio suggests a more balanced pay structure.

-

Total compensation

Total compensation for executives includes both fixed and variable pay elements. It consists of:

Base pay

Bonuses

Equity compensation (stock options or shares)

-

Performance metrics

Executive pay is closely linked to performance metrics that measure an executive's impact on the company. These metrics fall into two types:

Company-based metrics: Measure overall business success, including revenue growth, profit per share (EPS), shareholder returns (TSR), and investment gains (ROI).

Functional or Department-based metrics: Track performance in specific areas like sales, efficiency, or innovation.

Methods for benchmarking executive pay

The goal of setting executive pay is to stay competitive and fair. Companies use different benchmarking methods to align pay with industry trends and business goals. Here are four key methods:

-

Internal benchmarking

Internal benchmarking compares executive pay within the same company. This helps ensure fairness among leaders in similar roles and prevents large pay gaps. It also keeps pay structures consistent and avoids dissatisfaction among executives.

For example, if two executives hold similar responsibilities, their pay should be aligned based on their contributions and performance.

-

External benchmarking

External benchmarking compares executive pay with similar companies in the industry, region, or market. This helps businesses stay competitive and attract top executive talent.

Companies select a benchmarking group—a set of businesses they compete with for executives. They use salary surveys and public reports to see how their pay compares. If an organization pays less than its competitors, it may need to adjust salaries to retain key leaders.

-

Market-based benchmarking

Market-based benchmarking sets executive pay using general market data and data analytics, focusing on cash compensation (base salary plus bonuses). Companies analyze industry reports and economic trends to determine a fair and competitive salary range.

For example, if market data shows that CFOs in a specific industry earn $500,000 plus a 50% bonus, a company can use this information to set its CFO’s pay accordingly.

-

Peer group analysis

Peer group analysis compares executive pay with similar or aspirational companies. It helps businesses align their pay with successful firms or those they want to compete with in the future.

With Salary.com's compensation data, organizations can access pay details for 50,000+ executives, including salary, bonuses, equity, incentives, and benefits. Through this data, they can compare compensation practices with peer groups.

Challenges with executive compensation benchmarking

Below are the challenges organizations are likely to face when conducting executive compensation benchmarking:

-

Availability of data

As mentioned earlier, accessing reliable data is challenging, especially for private companies without public disclosure requirements. Global benchmarking adds complexity due to cultural norms, regulations, and economic conditions that impact how executive pay is structured.

For organizations benchmarking pay globally, Salary.com provides HR-reported surveys on senior management compensation in over 100 countries. These surveys cover salaries, incentives, allowances, and merit increases to ensure competitive compensation.

-

Comparability between companies

Companies differ in size, industry, and business models, making direct comparisons challenging. A startup in the tech sector may structure pay differently from a traditional manufacturing firm.

-

Performance metrics

Many performance metrics include subjective elements, making comparisons difficult. Even financial metrics such as revenue growth or shareholder returns can be influenced by external factors.

-

Hidden compensation (perks and benefits)

Executive pay includes salary, bonuses, and perks like housing allowances, company cars, and deferred compensation, which can add significant value but may not always appear in benchmarking data.

-

Regulatory changes

Laws on executive pay, disclosure requirements, and tax treatments vary by region and can change over time. Keeping up with regulatory updates is important to ensure compliance and avoid benchmarking errors.

-

Subjectivity in peer selection

Selecting peer companies for benchmarking is often subjective. Some organizations may choose peers that justify higher pay instead of reflecting a fair market rate.

-

Ethical considerations

Excessive executive pay can raise ethical concerns, especially if compensation gaps between executives and employees are too wide.

How to benchmark executive compensation

Now that you understand the meaning and components of executive compensation, let's explore the steps to effectively benchmark it.

-

Step 1: Identify comparable companies (custom peer group selection)

Choosing the right peer group is critical for accurate comparisons. Companies should look at industry, size, location, and business complexity. The group should include competitors and firms attracting similar executives to ensure relevant benchmarking.

-

Step 2: Gather reliable compensation data

Reliable benchmarking needs high-quality pay data from trusted sources. Companies can use industry surveys, SEC filings, proxy statements, and compensation software. Gathering data on salary, bonuses, stock options, and benefits from multiple sources improves accuracy.

-

Step 3: Analyze total compensation and pay mix

Executive pay includes fixed salary and variable incentives. Companies should compare their pay mix to the market, analyzing salary, bonuses, stock options, and benefits. A balanced pay mix ensures competitive and performance-driven compensation.

-

Step 4: Compare pay levels relative to performance

Speaking of performance-driven compensation, benchmarking should assess more than market rates. Companies must ensure executive pay aligns with financial performance, shareholder returns, and goals. Metrics like revenue growth, profitability, stock performance, and ROE help evaluate this. If pay exceeds performance, adjustments may be needed.

-

Step 5: Document and communicate findings

After analyzing the data, companies should document key insights, gaps, and recommendations in a report. Sharing findings with the board, compensation committees, and stakeholders ensures transparency. Proper records also support decisions and compliance.

Remember, a well-structured benchmarking process ensures competitive pay, aligns compensation with performance, and supports long-term business success. To build an effective executive compensation strategy, rely on accurate and up-to-date compensation surveys or data.

Insights You Need to Get It Right