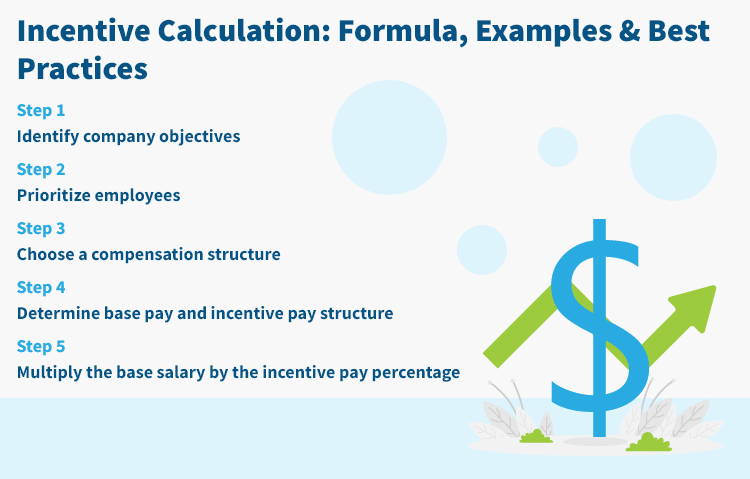

Incentive Calculation: Formula, Examples & Best Practices

- Step 1. Identify company objectives.

- Step 2. Prioritize employees.

- Step 3. Choose a compensation structure.

- Step 4. Determine base pay and incentive pay structure.

- Step 5. Multiply the base salary by the incentive pay percentage.

According to a 2024 report, employees who are well-recognized are 45% less likely to leave their jobs. One effective way to appreciate the workforce is through incentive compensation.

Aside from a competitive salary, workers are more motivated to perform well in an organization where incentives are given for their efforts. It encourages employees to extend more dedication, leading to productivity and business success.

Of course, when it comes to incentive compensation, the calculation process must be fair and accurate. In this article, we will discuss how to calculate incentive pay, some examples, common mistakes, and best practices to effectively execute incentive calculation.

What is incentive pay?

Incentive pay is compensation based on an employee’s performance. When employees perform well or achieve specific goals, they are given incentives either through financial compensation, such as bonuses and commissions, or non-financial compensation, such as recognition and career development.

So, what is the formula for incentives? The formula used for incentive compensation calculation is Incentive Pay = (Base Salary) x (Incentive Pay Percentage).

For example, Employee A has an annual base salary of $100,000 with an incentive pay percentage of 5%. Employee A receives an incentive payment of $5,000. So, Employee A has an additional pay of $5,000 on top of his base salary, amounting to $105,000.

Facilitating incentives for employees is now made easier through intact formulas, accurate and centralized planning, multi-factor bonuses, and effective incentive reporting. These can all be achieved through Compensation Planning Software.

Types of incentive pay

Incentive pay is divided into two categories: casual and structured incentives. Casual incentives are given at any time to high-performing employees, like gift cards, extra time off, and small tokens. Structured incentives have established schedules and according to specific percentage rates, such as annual bonuses and sales targets.

No matter the type, these incentive pay examples can be used by companies to create a highly motivating compensation structure. To give you more ideas, here is a comprehensive list of the different types of incentives:

Sales-based incentives: This is most common in sales rep teams, where incentives are according to the sales performance, such as commissions. Incentive calculation can be the total sales percentage or a fixed amount for achieving sales targets.

Performance-based incentives: This reflects an employee’s productivity, project success, or customer satisfaction. This is given in the form of bonuses to employees who perform well in the company.

Retention bonuses: These are given to employees who stay in the company for a specific period and are used to retain top talent in competitive industries.

Profit-sharing: Based on a company’s profitability, employees are rewarded with a portion of the revenue either through direct cash payments or indirect contributions to employee benefits like retirement plans.

Fringe benefits: This is also called employee benefits, which includes non-salary compensation and company perks like health insurance, paid time off, retirement plans, and fitness incentives.

Incentive compensation pros and cons

Incentive compensation comes with a fair share of advantages when effectively managed and disadvantages when missteps are made. Here are the pros and cons of an incentive pay plan in an organization:

Pros

Achieves company goals: It helps companies align their business objectives with the employees' effort and dedication, leading to the accomplishment of organizational targets and priorities.

Empowers the workforce: It motivates employees to maintain and increase their productivity as their work is valued through rewards and incentives. It also boosts employee morale and satisfaction, leading to a more positive work environment.

Recognizes top talents: Since high-performing employees are acknowledged, they are more likely to stay in the company. This enhances the reputation of the organization by providing career development, a skilled workforce, and company success.

Cons

Unhealthy employee behavior: Incentives can cause employees to lose sight of broader responsibilities and only focus on tasks that will get rewards. This breeds negative behaviors as they focus on the results and not the quality of the process.

Prone to bias: Performance metrics can be influenced by varying relationships between managers and employees, leading to wage discrimination and workplace biases.

Can build employee tension: Employees might practice unethical sales practices just to receive incentive pay. Competition can lead to aggression, jealousy, and decreased employee morale.

How is incentive pay calculated?

Incentive calculation can be a straightforward process, but prior to determining the incentives each employee gets for their performance, there are important factors to consider when implementing an effective incentive program. Here is how to calculate incentive pay and the process leading up to it:

-

Step 1: Identify company objectives

Having clear goals and priorities in an organization is important in establishing an incentive compensation plan. A company’s objective can vary depending on its vision and business strategy. The goal can be to increase sales or boost customer satisfaction, among others.

-

Step 2: Prioritize employees

Part of the incentive calculation is the base salary given to employees, so make sure that the regular salary is fair and competitive value for the work they do. Remember that base pay is as important as incentives. This will help your company prioritize the workforce.

-

Step 3: Choose a compensation structure

Decide on the type of incentive pay to use. It can be either team or individual compensation. Individual incentive is more common, while team incentive promotes a collaborative culture. Also, decide whether employees will receive a percentage-based incentive or a fixed amount.

-

Step 4: Determine base pay and incentive pay percentage

The base salary is the fixed pay an employee gets, excluding all additional compensation and benefits like bonuses and commissions, while the incentive pay percentage is the portion the employee gets from their performance.

For example, Employee B earns $150,000 as a base salary every year, and the incentive pay percentage she gets after hitting a sales quota is 7%.

-

Step 5: Multiply the base salary by the incentive pay percentage

If a company chooses the percentage-based system, to calculate incentive pay for Employee B, multiply the $150,000 base salary with the 7% incentive pay percentage. Employee B gets an incentive compensation of $10,500 on top of her fixed salary.

Calculating and managing a company’s incentive structure does not have to be complex with Incentive Compensation Software, where you can transfer data from spreadsheets, retain essential formulas like pay-for-performance and proration, and import vital business metrics to handle intricate incentive calculations, planning, and reporting.

Incentive calculation examples

Here are some examples of incentive compensation calculation:

-

Graduated commission

Company A offers an 8% commission for $100,000 sales, a 9% commission for $100,001 to $300,000 sales, and a 10% commission for $300,001 to $500,000 sales. In April, Employee A generated $200,000 in sales. So, he gets a 9% commission.

For incentive calculation, multiply the sales generated by the commission rate.

$200,000 x 0.09 = $18,000

Employee A gets $18,000 as an incentive pay for hitting the 9% commission.

-

Split commission

Company B offers a 10% commission on sales. Team B, which has 3 members, generated $500,000 in sales in May.

For incentive calculation, multiply the generated sales by the commission rate, then divide it by the number of members in Team B.

($500,000 x 0.10) / 3 = $16,667

Each member of Team B gets $16,667 as an incentive pay for a 10% commission.

Common mistakes in incentive calculation

Incentive compensation calculation is prone to mistakes. Here are some to help you avoid committing them:

-

Not considering external factors: Aside from company objectives, there are important considerations in calculating incentives, such as market trends and industry competition. These factors help with the accomplishment of company targets.

-

Using complex formulas: When the team does not understand how their incentives are calculated, it is too complicated and prone to confusion and doubts. Simplify the formula used for incentive calculation and maintain clear communication.

-

Incorrect manual inputs: Manual incentive calculations are prone to human errors and inaccurate data inputs, leading to faulty resource allocation and payouts. It is better to automate incentive processes that are susceptible to manual errors.

Best practices for incentive calculations

To mitigate common mistakes in incentive compensation calculation, here are some of the best practices you can apply in your organization:

-

Be transparent: Pay transparency can be done through showing employees the incentive calculations, reports, and total rewards statements. This promotes clear communication, trust, and motivation for employees.

-

Conduct regular review and feedback: Since the industry is dynamic, always update the company’s incentive plan and calculations by asking input from team members and gaining insights from the current job market.

-

Use automation: Incentive compensation is crucial in keeping employees motivated and productive, so the process must be free from errors. Automating the system helps companies save resources and streamline their workflow.

To automate your company’s entire incentive strategy, Compensation Planning Software simplifies incentive calculations, provides comprehensive commission statements, and unifies your systems for sales compensation and total rewards management.

Insights You Need to Get It Right