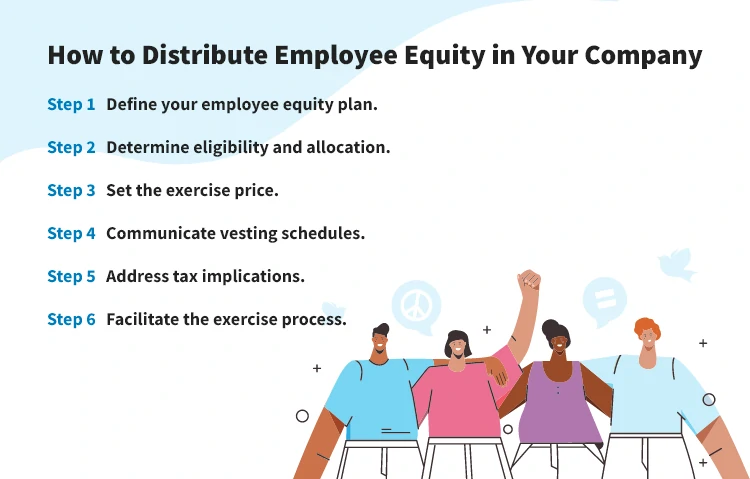

How to Distribute Employee Equity in Your Company

- Step 1. Define your employee equity plan.

- Step 2. Determine eligibility and allocation.

- Step 3. Set the exercise price.

- Step 4. Communicate vesting schedules.

- Step 5. Address tax implications.

- Step 6. Facilitate the exercise process.

Start-ups and public companies often use employee equity plans to improve their compensation packages. Understanding employee equity can improve your ability to recruit and retain high-quality staff as it offers a creative way to reward employees while preserving cash flow.

With Salary.com's Pay Equity Feature, you can gain access to the industry’s only true end-to-end solution for addressing the gender pay gap, employee equity issues, general pay inequality, and more.

What is employee equity?

Employee equity compensation is a form of non-cash pay that gives employees a stake in the company. This can be offered as stock options, restricted stock units, or performance shares, providing a financial benefit that aligns employees' interests with the company's success.

Typically, equity compensation comes with a vesting period, requiring employees to stay with the company for a certain time before fully owning their shares. The equity pool, usually 10% to 15% of the company's stock, is set by the founders and can vary based on the company's needs and the founders' involvement.

With Salary.com's Pay Equity Audit & Certification, you can address compensation issues by assessing your organization’s internal and external compensation strategies.

How does equity compensation work?

Equity compensation structures employee interests with shareholder value to motivate employees to work towards the company's best interests. It is an important part of the compensation package, with types like stock options and restricted stock units defined in the employment agreement.

Once vesting requirements are met, employees can sell their company stock or keep it for long-term investment, with the value fluctuating based on the company's stock price. They can benefit from financial gains as the company grows, especially if the stock price increases.

With Continuous Pay Analysis, you can manage your pay equity process as frequently as you like and archive all results for audit purposes.

How do you determine employee equity?

Determining employee equity starts with understanding the types of equity compensation available. Options like stock options, restricted stock, and employee stock purchase plans each offer unique benefits, such as tax advantages and the ability to purchase company stock at a discounted price.

To decide how much equity to grant, consider the fair market value and the company’s cash flow. Balancing cash compensation with equity-based compensation ensures rewarding employees while maintaining financial stability, whether for startup employees or key employees in public companies.

Types of equity compensation

Companies can provide various equity compensation options for employees, each with distinct advantages and disadvantages for both employees and employers. Here are five common types of employee equity:

-

Stock Options

Employees get the right to buy company stock at a set price, usually below market value, for a specific period. If the company's stock value rises, this can be more rewarding than a higher annual salary.

-

Restricted Stock

Employees receive company stock with conditions like vesting schedules or performance targets. This ensures commitment and performance but might feel restrictive to employees.

-

Employee Stock Purchase Plans (ESPPs)

Employees can buy company stock at a discount through payroll deductions. This is a great way for non-executives to invest in the company and enjoy stock ownership.

-

Performance Shares

Employees earn shares by hitting specific performance goals, usually reserved for higher-level managers and executives. These shares reward top performers without requiring them to buy stock.

-

Deferred Compensation

Employees defer part of their salary or bonus until retirement, helping with long-term financial planning and tax benefits. However, this can feel risky if the company's future stability is uncertain.

Employee equity vs. team equity

Team equity involves how founders divide a startup's initial ownership, often leading to full ownership except when some shares are reserved for employee equity. The split can be influenced by factors like idea ownership, investment, and dedication, ensuring a fair division of equity compensation among the founding team.

Employee equity, on the other hand, refers to distributing company stock to employees, which doesn’t necessarily involve the founders. This type of equity compensation, which includes stock options and incentive stock options, grants employees ownership stakes that's meant to encourage them to invest in the company’s success and provides a different incentive structure than team equity.

Salary.com's Define Comparable Work feature can take a close look at your organization’s roles, pay structure, and people to ensure that similar roles receive similar compensation.

Why is equity compensation important?

Equity compensation is crucial for startups to attract and retain top talent when they can't compete with the cash compensation offered by established companies. Offering employee equity and stock options allows startups to inspire employees to share the company’s vision and feel motivated to contribute to its success.

With Assess Pay Gaps feature, you can evaluate your compensation practices, pay levels, and determine if they are aligned with your business goals and DE&I initiatives.

Benefits of distributing employee equity compensation

Companies that offer employee equity compensation can expect the following benefits:

Enhanced employee loyalty

When employees have a stake in the company through equity compensation, they feel more invested in the company's success. This develops loyalty and encourages long-term commitment.

Increased motivation and performance

Equity awards like incentive stock options provide a direct link between an employee's efforts and the company's performance. When the company succeeds, employees benefit financially.

Attracting top talent

Offering an equity compensation plan helps attract highly skilled candidates, especially in competitive job markets. Equity-based compensation shows potential hires that they can share in the company’s growth, making the offer more appealing.

Cash flow management

For private companies, equity compensation is an effective way to compensate employees without the immediate cash outflow. Non-cash compensation like stock options allows companies to conserve cash while still rewarding employees.

Aligning interests

Employee equity plans position the interests of employees with those of the company and its shareholders. When employees exercise vested options and purchase shares at a predetermined price, they are directly invested in the company’s true value and future success.

Regression & Cohort Analyses can assess pay gaps to determine if there are any pay differences between gender and other protected classes that are statistically significant.

Tax benefits

Certain types of equity compensation can offer tax advantages for employees. Carefully planning the timing of option grants and exercises allows both employees and the company to optimize their tax consequences.

How to distribute employee equity in your company

Understanding the process and knowing how much equity to give your employees in different roles can be a challenge. Here are the simple steps you can follow to effectively distribute employee equity in your company:

-

Step 1: Define your employee equity plan

Outline your employee equity plan, detailing the total equity available and the types of equity awards you will offer. Ensure your plan aligns with your company's goals and compensates employees fairly. This is not the obligation but a strategic move to improve employee compensation and retention.

-

Step 2: Determine eligibility and allocation

Decide which employees are eligible to participate in the equity plan and how much equity each will receive. Consider factors like job role, performance, and tenure on a case-by-case basis. Ensure that everyone understands their potential equity award and the criteria behind it.

-

Step 3: Set the exercise price

Establish the exercise price or strike price for the stock options, which is the price at which employees can buy company shares. This price should reflect the current market value of the shares. Clearly communicate this to employees so they understand the financial commitment when they exercise options.

-

Step 4: Communicate vesting schedules

Explain the vesting schedule to employees, including when they can exercise their options and the implications of unvested options. Make sure they know how long they need to stay with the company before they can fully exercise their options. This helps manage expectations and motivates long-term commitment.

Salary.com can even help your organization in Communicating Pay Equity to establish a consistent message about pay and affirm that your organization believes in fair and equitable pay for all.

-

Step 5: Address tax implications

Inform employees about the tax implications, including the alternative minimum tax (AMT) and other tax considerations. Different types of stock options such as non-qualified stock options have different tax treatments, and employees need to understand these.

For example, stocks you acquire or purchase through a stock plan count as income and usually get taxed as regular income. When you sell those stocks, you'll also need to report any profit or loss.

-

Step 6: Facilitate the exercise process

Make it easy for employees to exercise their options when the time comes and provide clear instructions on how to exercise options. Ensure they know what they will receive, whether it's company shares or another form of compensation, such as an incentive stock option.

Equity-based compensation develops a sense of ownership and investment in the company's future. When employees have equity awards and see their compensation tied to the company’s outcome, they are driven to work harder and perform in the company's best interests. Thanks to Salary.com's Pay Equity Feature, you can address your employee equity distribution issues and many more with the industry's leading pay equity solution.

Insights You Need to Get It Right