Salary Surveys 20|20: Types of Market Data

Written by Jonathan Sweet

July 13, 2020

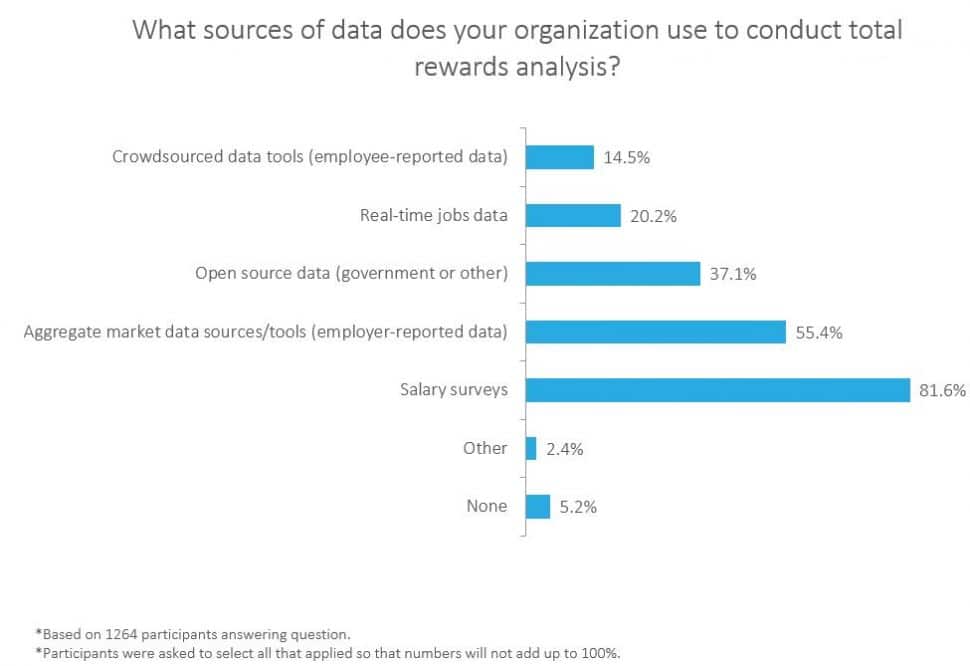

Despite mergers and acquisitions within and by the large survey houses over the years, there is much more data available today than there was a decade ago. With advances in ERP, HRIS and payroll software applications, HR and compensation professionals can easily extract files and submit data to survey vendors quicker than ever before.

Survey vendors have also improved in several ways by utilizing software and artificial intelligence in mapping, collecting, validating, and reporting large data sets. This frees up more time for the human interaction to follow up and directly service participants who may need additional assistance with their participation. Furthermore, technology and innovation has led to new and exciting data offerings which have gained traction and have found their place within the compensation practitioners tool kit.

- Domestic and Global Participant surveys are the preferred source of compensation data. These surveys typically require participation to gain access to results. Many vendors offer non-participant options but be prepared; you are going to pay a premium for it. In the United States there are quite a few firms to choose from. Outside the US options for data is much more limited. In some global markets there may be as few as a handful of survey options available, perhaps less.

- Aggregated employer reported data is a great augment to traditional salary surveys to fill in gaps where data may be insufficient or unavailable. Coupled with survey data you can achieve wide coverage of your jobs across various pay markets with defensible, peer driven data. Aggregated employer reported data is an assessment of the market by a vendor utilizing multiple employer-reported salary surveys as the backbone of the research. The results are a blend of those sources of data. The sources of which are matched as closely to the user’s selection of an industry, geography, and company size as possible. The availability of more precise data typically not covered by salary surveys is the result of an adjustment where data in a user’s selection is thin or non-existent.

- Free publicly available data such as local, state, federal government data and regulatory report filings such as the Bureau of Labor Statistics, public company proxy, non-profit and H1B. Other sources of free, publicly available data include job boards and company job postings.

- Employee reported/crowd-sourced data has found its way to HR and compensation professionals with mixed impressions. According to a 2017 Compensation Trend Survey conducted by Salary.com polling more than 1,200 compensation and HR professionals, 70% of respondents stated they aren’t comfortable using employee-reported data to determine market rates for jobs, with under 2% of respondents stating they would use it as their only source of salary benchmark data.

Fast forward to the 2019 Pay Practices Survey conducted by Salary.com which reports 66% of nearly 1,500 compensation and HR professionals polled stated they are not comfortable using employee data to determine market rates for positions.

Digging in a bit further to determine how and when folks might use this type of data: 27% of respondents stated they would use it as a data point in an overall market assessment, 20% as a data point in pricing a single job, with 18.5% suggesting they would use the data as a gut check on a single job, but not as a data point in the market pricing itself. 35% responded they would not use employee reported or crowd-sourced data at all.

Source: Salary.com 2019 Pay Practices and Compensation Strategy Survey

Source: Salary.com 2019 Pay Practices and Compensation Strategy Survey .

Source: Salary.com 2019 Pay Practices and Compensation Strategy Survey

Source: Salary.com 2019 Pay Practices and Compensation Strategy Survey

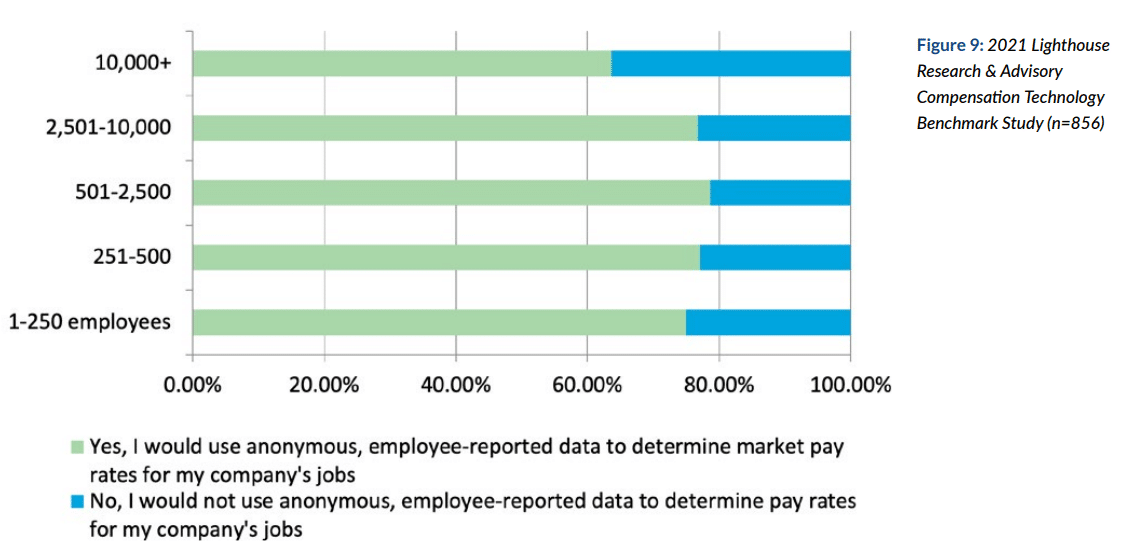

The data landscape with respect to adoption of non-traditional data sources continues to change rapidly. Confirming this, a 2021 Lighthouse Research & Advisory Compensation Technology Benchmark Study reveals asserts as much as 75% would use employee reported data in their practice. The article goes on to state “While this should not be the only source of information when pricing jobs, it’s clear that more talent and compensation leaders are open to leveraging any data source that gives them a closer approximation of the right price for the right job at the right time.”

The report goes on to update how companies of different sizes would use employee-reported data in their practice. The numbers have risen significantly since 2019 (27%) vs 2021 (upwards to 70%). It concludes, “larger employers are generally less likely to rely on this kind of data for pricing purposes, but when compared to previous data, every group is leaning more heavily into this type of data source as a validation tool”

So why is it gaining traction? Crowd-sourced or employee-reported data offer a low barrier to entry not only with cost (free), but also from a time commitment perspective (nothing required outside payment). With bandwidth limited in HR, recruiting for many is not restricted to a narrow radius with work-from-home. Crowd-sourced data can be far reaching, inexpensive and a data point candidates themselves consult and perhaps expect in potential offers. Although the data is somewhat of a ‘black box’ requiring significant, unknown backend algorithms and statistical analysis, unlike the rigor and protections of Safe Harbor associated with surveys, crowd-sourced data can be published at a greater frequency and in theory reported without lag. This is attractive to many and a data point to consider for sure.

- Modeled data Curated data with scoping capabilities for example at the peer group level. This data set is comprised of multiple data points ranging from the traditional (survey and aggregated data) to the non-traditional (free, crowd-sourced, job boards, government, and other auxiliary data points). This data although highly configurable, is a manufactured data point blending multiple collection and processing methodologies.

What’s interesting is these “alternative data sources” either use salary survey data as the foundation of their software products (Salary.com) or use survey data to verify or validate their crowd-sourced employee reported data offering (Payscale).

In our next post we will provide some helpful tips for managing your relationship with your survey partner(s).

The Compdata and IPAS survey practice at Salary.com is one of the largest compensation data providers in the world with compensation and benefits data spanning 100 countries across 17 industry verticals. To learn more, contact us at 781-552-4596.

Download our white paper to further understand how organizations across the country are using market data, internal analytics, and strategic communication to establish an equitable pay structure.

Insights You Need to Get It Right